Abstract

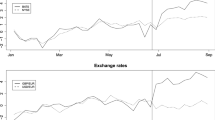

Methods for detecting structural changes, or change points, in time series data are widely used in many fields of science and engineering. This chapter sketches some basic methods for the analysis of structural changes in time series data. The exposition is confined to retrospective methods for univariate time series. Several recent methods for dating structural changes are compared using a time series of oil prices spanning more than 60 years. The methods broadly agree for the first part of the series up to the mid-1980s, for which changes are associated with major historical events, but provide somewhat different solutions thereafter, reflecting a gradual increase in oil prices that is not well described by a step function. As a further illustration, 1990s data on the volatility of the Hang Seng stock market index are reanalyzed.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

M. Kelly, C. O’Grada, Change points and temporal dependence in reconstructions of annual temperature: did Europe experience a little Ice Age? Ann. Appl. Stat. 8, 1372–1394 (2014)

P. Hackl, A. Westlund, Statistical analysis of “structural change”: an annotated bibliography. Empir. Econ. 14, 167–192 (1989)

A. Zeileis, F. Leisch, K. Hornik, C. Kleiber, strucchange: An R package for testing for structural change in linear regression models. J. Stat. Softw. 7, 1–38 (2002)

P. Perron, Dealing with structural breaks, in Palgrave Handbook of Econometrics: Volume 1: Econometric Theory, ed. by K. Patterson, T.C. Mills (Palgrave Macmillan, London, 2006), pp. 278–352

A. Aue, L. Horváth, Structural breaks in time series. J. Time Ser. Anal. 34, 1–16 (2013)

L. Horváth, G. Rice, Extensions of some classical methods in change point analysis. TEST 23, 219–255 (2014)

M. Csörgő, L. Horváth, Limit Theorems in Change-Point Analysis (Wiley, Hoboken, NJ, 1997)

E. Andreou, E. Ghysels, Detecting multiple breaks in financial market volatility dynamics. J. Appl. Econ. 17, 579–600 (2002)

R.L. Brown, J. Durbin, J.M. Evans, Techniques for testing the constancy of regression relationships over time. J. R. Stat. Soc. Ser. B 37, 149–163 (1975)

W. Ploberger, W. Krämer, The CUSUM test with OLS residuals. Econometrica 60, 271–285 (1992)

R Core Team, R : A Language and Environment for Statistical Computing (R Foundation for Statistical Computing, Vienna, 2016)

C.-M. Kuan, K. Hornik, The generalized fluctuation test: a unifying view. Economet. Rev. 14, 135–161 (1996)

A. Zeileis, A unified approach to structural change tests based on ML scores, \(F\) statistics, and OLS residuals. Economet. Rev. 24, 445–466 (2005)

J. Bai, P. Perron, Estimating and testing linear models with multiple structural changes. Econometrica 66, 47–78 (1998)

J. Bai, P. Perron, Computation and analysis of multiple structural change models. J. Appl. Econ. 18, 1–22 (2003)

R. Bellman, R. Roth, Curve fitting by segmented straight lines. J. Am. Stat. Assoc. 64, 1079–1084 (1969)

A. Zeileis, C. Kleiber, W. Krämer, K. Hornik, Testing and dating of structural changes in practice. Comput. Stat. Data An. 44, 109–123 (2003)

D.S. Matteson, N.A. James, A nonparametric approach for multiple change point analysis of multivariate data. J. Am. Stat. Assoc. 109, 334–345 (2014)

M.L. Rizzo, G.J. Székely, DISCO analysis: a nonparametric extension of analysis of variance. Ann. Appl. Stat. 4, 1034–1055 (2010)

N.A. James, D.S. Matteson, ecp: An R package for nonparametric multiple change point analysis of multivariate data. J. Stat. Softw. 62, 1–25 (2014)

P. Fryzlewicz, Wild binary segmentation for multiple change-point detection. Ann. Stat. 42, 2243–2281 (2014)

M. Frisén, Optimal sequential surveillance for finance, public health, and other areas. Seq. Anal. 28, 310–337 (2009)

A.N. Shiryaev, Quickest detection problems in the technical analysis of financial data, in Mathematical Finance—Bachelier Congress 2000, Paris, June 29–July 1, 2000, ed. by H. Geman, D. Madan, S. Pliska, T. Vorst (Springer, Heidelberg, 2002), pp. 487–521

H. Wickham, ggplot2 : Elegant Graphics for Data Analysis (Springer, Heidelberg, 2009)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG

About this chapter

Cite this chapter

Kleiber, C. (2018). Structural Change in (Economic) Time Series. In: Müller, S., Plath, P., Radons, G., Fuchs, A. (eds) Complexity and Synergetics. Springer, Cham. https://doi.org/10.1007/978-3-319-64334-2_21

Download citation

DOI: https://doi.org/10.1007/978-3-319-64334-2_21

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-64333-5

Online ISBN: 978-3-319-64334-2

eBook Packages: EngineeringEngineering (R0)