Abstract

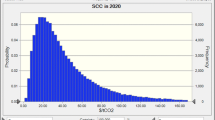

The theory of real options has received a considerable interest in recent years. At the core of the literature has been a so-called single-option model, i.e. a model where the decision-maker must decide the timing of a real investment given stochastic returns of the single asset in question and where the investment is a sunk cost. This paper extends the field of real-options theory by analysing the case where the decision-maker must decide on the timing of an investment facing the choice between two mutually exclusive real options with stochastic and possibly correlated returns. The paper presents a simple two-period model, outlines a continuous-time model, and presents some results of a numerical solution procedure for the case of afforestation.

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

Bibliography

Ahildtrup, J., and Strange, N. 1999. The option value of non-contaminated forest watersheds. Journal of Forest Policy and Economics, 1: 115 - 125.

Arrow, K.J., and Fisher, A.C. 1974. Environmental preservations, uncertainty and irreversibility. Quarterly Journal of Economics, 83: 312 - 319.

Black, F., and Scholes, M. 1973. The pricing of options and corporate liabilities. Journal of Political Economy, 81: 637 - 659.

Dixit, A., and Pindyck, R.S. 1994. Investment under uncertainty. Princeton University Press, Princeton, New Jersey.

Henry, C. 1974. Option values in the economics of irreplaceable assets. Review of Economic Studies, 41: 89 - 104.

Malchow-Moller, N., and Thorsen, B.J. 2000. Investment under uncertainty - the case of repeated options. Working Paper. University of Aarhus, Department of Economics. 3Opp.

Malliaris, A., and Brock, W. 1982. Stochastic methods in economics and finance. North-Holland, Amsterdam, the Netherlands.

Mcdonald, R., and Siegel, D. 1986. The value of waiting to invest. Quarterly Journal of Economics, 101: 707 - 728.

Reed, W. 1993. The decision to conserve or harvest old-growth forest. Ecological Economics, 8: 45 - 49.

Stultz, R.M. 1982. Options on the minimum or maximum of two risky assets: Analysis and applications. Journal of Financial Economics, 10: 161 - 185.

Thomsen, T.A. 1992. Option pricing and timberlands land-use conversion option: comment. Land Economics, 68: 462 - 469.

Thorsen, B.J. 1999. Afforestation as a real option: some policy implications. Forest Science, 42: 171 - 178.

Thorsen, B.J., and Malchow-Moller, N. 2001. Optimal stopping with two mutually exclusive options. Working paper. University of Aarhus, Department of Economics. (in prep.).

Zinkhan, F.C. 1991. Option pricing and timberlands land-use conversion option. Land Economics, 67: 317 325.

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2003 Springer Science+Business Media Dordrecht

About this chapter

Cite this chapter

Thorsen, B.J., Malchow-Møller, N. (2003). Afforestation as a real option: Choosing among options. In: Helles, F., Strange, N., Wichmann, L. (eds) Recent Accomplishments in Applied Forest Economics Research. Forestry Sciences, vol 74. Springer, Dordrecht. https://doi.org/10.1007/978-94-017-0279-9_6

Download citation

DOI: https://doi.org/10.1007/978-94-017-0279-9_6

Publisher Name: Springer, Dordrecht

Print ISBN: 978-90-481-6221-5

Online ISBN: 978-94-017-0279-9

eBook Packages: Springer Book Archive