Abstract

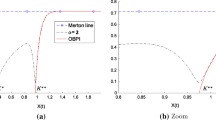

Specialized funds such as charitable trusts do not attach much value to consumption, instead, they pursue to maintain a satisfactory level of spending and avoid ruin to achieve their managerial goals. We employ an objective function tailored for studying ruin probability of a specialized fund, which implies simple analytical conditions to judge if the fund can be operable permanently. We analytically show that even if the fund has fixed portfolio weights and faces both fixed and proportional maintaining cost, there may still exist a positive probability for the fund to maintain operability permanently. Since if the stock is profitable enough, the wealth process has a large positive drift to offset effects of the fixed cost and downside risk. We extend the benchmark model to a case allowing portfolio rebalance between risky assets, and also obtain analytical expressions for optimal portfolio choices and ruin probability. Allowing portfolio selection potentially improves survival probability. Finally, we provide conditions needed to enjoy a positive probability of permanent survival when the fund can invest in a short bond (potentially with a risky asset) with stochastic nominal riskless interest rate.

Similar content being viewed by others

Explore related subjects

Discover the latest articles and news from researchers in related subjects, suggested using machine learning.Notes

It is due to the assumption of infinite horizon which implies that the Bellman equation can be simplified to an ODE. Whereas, in a standard Merton model with deterministic finite horizon, the value function will be a function of time, usually leading to the Bellman equation as a PDE. Specifically, conditional on the same amount of wealth w, the value function P will be independent of time t, because let \(P\left( w\right) \equiv {\mathrm {E}}\left[ \int _{0}^{\infty }d\iota _{s}\left| w_{0}=w^{*}\right. \right]\), then for any finite t, we will also have \({\mathrm {E}}\left[ \int _{t}^{\infty }d\iota _{s}\left| w_{t}=w^{*}\right. \right] =P\left( w\right)\). To prove, just let \(v=s-t\), then we have \({\mathrm {E}}\left[ \int _{t}^{\infty }d\iota _{s}\left| w_{t}=w^{*}\right. \right] ={\mathrm {E}}\left[ \int _{0}^{\infty }d\iota _{v}\left| w_{0}=w^{*}\right. \right] =P\left( w\right)\).

Chapter 6 of Abramowitz and Stegun (1970) shows the detailed definition and properties of different kinds of incomplete Gamma function.

The value of indicator \(\iota _{t}\) depends on if wealth w is zero or not. Hence, essentially P and \(P^{s}\) are just functions of wealth. The presentation of two-variable function \(P\left( w_{t},\iota _{t}\right)\) is used mainly in the proof of verification theorem when applying Itô’s Lemma to highlight that the ruin probability P depends on the indicator which jumps from zero to one when wealth reaches zero. Since in most parts of the paper, we focus on the nontrivial case of \(\iota _{t}=0\), i.e., the fund is alive with positive wealth. Therefore, we simply omit the condition \(\iota _{t}=0\), and write \(P(w,\iota _{t}=0)\) as P(w). Moreover, note that when indicator \(\iota _{t}=1\), the ruin probability P is trivial and is always one.

It is a well-known result that geometric Brownian motion tends to increase to infinity with probability one with the right set of parameters. Since if

$$\begin{aligned} w_{t}=w_{0}\exp \left[ \int _{s=0}^{t}\left( \mu -\frac{1}{2}\sigma ^{2}\right) ds+\sigma Z_{t}\right] . \end{aligned}$$then \(\log (w_{t})\sim \Phi (\log (w_{0})+(\mu -\sigma ^{2}/2)t,\sigma ^{2}t)\). For any fixed \(X>0\),

$$\begin{aligned} {\text{ Pr }}(w_{t}\le X)={\text{ Pr }}(\log (w_{t})\le \log (X))=\Phi \left( \frac{\log (X)-\log (w_{0})-(\mu -\sigma ^{2}/2)t}{\sigma \sqrt{t}}\right) , \end{aligned}$$where \(\Phi (\cdot )\) is the standard normal cumulative distribution function. Therefore,

$$\begin{aligned} \lim _{t\uparrow \infty }\,{\text{ Pr }}\,(w_{t}\le X)=\left\{ \begin{array} [c]{ll} 0 & {\text {if }}\,\mu -\sigma ^{2}/2>0\\ 1/2 & {\text {if }}\,\mu -\sigma ^{2}/2=0\\ 1 & {\text {if }}\,\mu -\sigma ^{2}/2<0 \end{array} \right. . \end{aligned}$$The betaPERT distribution is often employed in sensitivity analysis. It is a continuous distribution. It describes a situation where the minimum, maximum, and most likely values to occur are known. It is similar to the triangular distribution, except the curve is smoothed to reduce the importance of peak. The parameters of the distribution are Minimum, Most Likely, Maximum.

References

Abramowitz M, Stegun IA (eds) (1970) Handbook of mathematical functions with formulas, graphs, and mathematical tables, vol 55. US Government Printing Office, Washington, DC

Albrecher H, Boxma OJ (2004) A ruin model with dependence between claim sizes and claim intervals. Insur Math Econ 35:245–254

Bodie Z, Merton RC, Samuelson WF (1992) Labor supply flexibility and portfolio choice in a life cycle model. J Econ Dyn Control 16:427–449

Cai J, Dickson DCM (2004) Ruin probabilities with a Markov chain interest model. Insur Math Econ 5(3):513–525

Calabrese TD, Ely TL (2017) Understanding and measuring endowment in public charities. Nonprofit Volunt Sector Q 46(4):859–873

Cardoso RMR, Waters HR (2005) Calculation of finite time ruin probabilities for some risk models. Insur Math Econ 37(2):197–215

Chen CJ, Panjer H (2009) A bridge from ruin theory to credit risk. Rev Quant Finance Acc 32(4):373–403

Chen AH, Fabozzi FJ, Huang D (2012) Portfolio revision under mean-variance and mean-CVaR with transaction costs. Rev Quant Finance Acc 39(4):509–526

Chidambaran NK (2007) Density estimation through quasi-analytic Monte–Carlo simulation: options arbitrage with transactions costs. Rev Quant Finance Acc 28(1):101–122

Christensen PO, Qin Z (2014) Information and heterogeneous beliefs: cost of capital, trading volume, and investor welfare. Acc Rev 89(1):209–242

Davis MHA, Varaiya PP (1973) Dynamic programming conditions for partially observable stochastic systems. SIAM J Control Optim 11:226–261

Day TE (1984) Real stock returns and inflation. J Financ 39(2):493–502

Du K, Fu Y, Qin Z, Zhang S (2020) Regime shift, speculation, and stock price. Res Int Bus Finance 52:101181

Dybvig PH (1995) Dusenberry’s ratcheting of consumption: optimal dynamic consumption and investment given intolerance for any decline in standard of living. Rev Econ Stud 62(2):287–313

Elie R, Touzi N (2006) Optimal lifetime consumption and investment under a drawdown constraint. Finance Stoch 12:299–330

Fama EF, Schwert GW (1977) Asset returns and inflation. J Financ Econ 5(2):115–146

Fama EF, French KR (2010) Luck versus skill in the cross section of mutual fund returns. J Finance 65:1915–1947

Fleming WH, Rishel RW (1975) Deterministic and stochastic optimal control. Springer, New York

French KR (2008) Presidential address: the cost of active investing. J Finance 63:1537–1573

Gultekin NB (1983) Stock market returns and inflation: evidence from other countries. J Financ 38(1):49–65

Guo B, Peng S (2020) Do nonprofit and for-profit social enterprises differ in financing? VOLUNTAS Int J Volunt Nonprofit Organ 31(3):521–532

Gutiérrez-Nieto B, Serrano-Cinca C, Molinero CM (2009) Social efficiency in microfinance institutions. J Oper Res Soc 60(1):104–119

Harel A, Francis JC, Harpaz G (2018) Alternative utility functions: review, analysis and comparison. Rev Quant Finance Acc 51(3):785–811

Hossain S, Galbreath J, Hasan MM, Randøy T (2020) Does competition enhance the double-bottom-line performance of microfinance institutions? J Bank Finance 113:105765

Hudon M, Périlleux A (2014) Surplus distribution and characteristics of social enterprises: evidence from microfinance. Q Rev Econ Finance 54(2):147–157

Kabanov Y, Pergamenshchikov S (2020) Ruin probabilities for a Levy-driven generalised Ornstein–Uhlenbeck process. Finance Stoch 24(1):39–69

Kashif M, Menoncin F, Owadally I (2020) Optimal portfolio and spending rules for endowment funds. Rev Quant Finance Acc 55:671–693

Kolm PN, Tutuncu R, Fabozzic FJ (2014) 60 years of portfolio optimization: practical challenges and current trends. Eur J Oper Res 234(2):356–371

Konstantinides DG, Li JZ (2016) Asymptotic ruin probabilities for a multidimensional renewal risk model with multivariate regularly varying claims. Insur Math Econ 69:38–44

Korn R, Kraft H (2002) A stochastic control approach to portfolio problems with stochastic interest rates. SIAM J Control Optim 40(4):1250–1269

Kwabi FO, Boateng A (2020) The effect of insider trading laws and enforcement on stock market transaction cost. Rev Quant Finance Acc. https://doi.org/10.1007/s11156-020-00914-9

Labie M, Méon P, Mersland R, Szafarz A (2015) Discrimination by microcredit officers: theory and evidence on disability in Uganda. Q Rev Econ Finance 58:44–55

Leipus R, Šiaulys J (2008) Asymptotics for random-time ruin probability in a time-dependent renewal risk model with subexponential claims. J Ind Manag Optim 12(1):31–43

Liang XQ, Young VR (2018) Minimizing the probability of ruin: optimal per-loss reinsurance. Insur Math Econ 82:181–190

Liang X, Liang Z, Young VR (2020) Optimal reinsurance under the mean-variance premium principle to minimize the probability of ruin. Insur Math Econ 92:128–146

Lim BH, Shin YH (2011) Optimal investment, consumption and retirement decision with disutility and borrowing constraints. Quant Finance 11:1581–1592

Liu H (2004) Optimal consumption and investment with transaction costs and multiple assets. J Finance 59:289–338

Liu H, Loewenstein M (2002) Optimal portfolio selection with transactions costs and finite horizons. Rev Financ Stud 15(3):805–835

Mersland R, Strøm RØ (2009) Performance and governance in microfinance institutions. J Bank Finance 33(4):662–669

Merton RC (1969) Lifetime portfolio selection under uncertainty: the continuous-time case. Rev Econ Stat 31(3):247–257

Merton RC (1971) Optimal consumption and portfolio rules in a continuous-time model. J Econ Theory 3:373–413

Munk C, Sørensen C (2004) Optimal consumption and investment strategies with stochastic interest rates. J Bank Finance 28(8):1987–2013

Qin Z (2013) Speculations in option markets enhance allocation efficiency with heterogeneous beliefs and learning. J Bank Finance 37(12):4675–4694

Rogers LCG (2013) Optimal investment. Springer, Berlin

Rolski T, Schmidli H, Schmidt V, Teugels J (1999) Stochastic processes for insurance and finance. Wiley, New York

Semenov A (2017) Background risk in consumption and the equity risk premium. Rev Quant Finance Acc 48(2):407–439

Serrano-Cinca C, Gutierez-Nieto B (2014) Microfinance, the long tail and mission drift. Int Bus Rev 23(1):181–194

Tchakoute-Tchuigoua H (2010) Is there a difference in performance by the legal status of microfinance institutions? Q Rev Econ Finance 50(4):436–442

Wermers RR (2000) Mutual fund performance: an empirical decomposition into stock-picking talent, style, transactions costs, and expenses. J Finance 55:1655–1703

Wijesiri M (2016) Weathering the storm: ownership structure and performance of microfinance institutions in the wake of the global financial crisis. Econ Model 57:238–247

Yang Y, Leipus R, Šiaulys J, Cang Y (2011) Uniform estimates for the finite-time ruin probability in the dependent renewal risk model. J Math Anal Appl 383(1):215–25

Acknowledgements

This paper is derived from the project “Stay Alive” developed jointly by Phil Dybvig and Zhenjiang Qin. We are very grateful to all the valuable comments and suggestions by Phil Dybvig. We also thank the participants of seminars in Washington University in Saint Louis and IFS SWUFE. All errors are our own.

Funding

Xiaorong Ma acknowledges financial support from Research Committee of University of Macau (SRG2019-00158-FBA). Zhenjiang Qin acknowledges financial support from Research Committee of University of Macau (SRG2018-00113-FBA and MYRG2018-00210-FBA).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Derivation of Bellman equation for benchmark model

We now solve for the ruin probability using the martingale technique pioneer by Fleming and Rishel (1975). Define

for \(t>0\), where \(P(\cdot ,\cdot )\) is the proposed value function defined as \(1-P^{s}\) and \(P^{s}\) is given in (8) in the statement of Proposition 1. This denotes the probability of subsequent termination in the future after date t. Note that by the dynamics of wealth (4) and by Itô’s Lemma (letting \(dt^{2}=dtdZ=0\), \(dZ^{2}=dt)\), we have

Moreover, the ruin probability as a conditional expectation should be a martingale. Because, a martingale do not have tendency to increase or decrease on average, and it well fit the role that it is bounded between 0 and 1 as a probability. Hence, the drift of M should be zero, gives rise to

which yields the following ODE for ruin probability at any finite time,

1.2 Verifying solution and derivation of ruin probability

To verify

is the solution of the ODE, we just need to derive

therefore,

which is just another form of the ODE (5). This verifies the solution.

Now we derive the analytical expression of ruin probability when \(\mu /\sigma ^{2}=1\). We have

Note that \(-\varpi ^{-2}d\varpi =d\varpi ^{-1}\), thus

Substitute the boundary conditions of

we have

hence, we obtain

and therefore

□

1.3 Proof of Proposition 2

1.3.1 Derivation of ruin probability

We now derive the solution of the following Bellman equation which is an ODE,

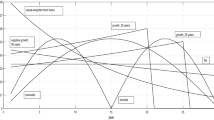

The first-order condition with respect to \(\theta\) gives

Substitute it back to ODE (21) yields

Let

we can rewrite the ODE as

Let

we have

Note that the ruin probability decreases with wealth, therefore, we have \(P_{w}<0\). Since we need to assume that \(P_{ww}>0\) to ensure a minimization problem, by the expression of optimal portfolio, we have \(g=P_{ww}/P_{w}<0\), therefore, we have \(g=g_{2}\left( w\right)\). Now to obtain the ruin probability, we only need to solve Eq. (22) with \(g=g_{2}\left( w\right)\).

Integration of both side of the Eq. (22) form 1 to w yields

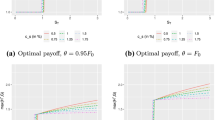

Integrating again from 0 to w yields the general solution of the ruin probability,

where constant \({\hat{C}}_{1}\) and \({\hat{C}}_{2}\) is to be determined by boundary conditions. Similar to the discussion in the previous section, we also have the two boundary conditions as

Imposing the two boundary conditions to (23) gives

Hence, to calculate \({\hat{C}}_{1}\) and, thus, the general solution, we need to first solve for function \(\int _{1}^{h}g\left( \varpi \right) d\varpi\). The following subsection provides an analytical expression of the indefinite integral \(\int g\left( \varpi \right) d\varpi\).

1.3.2 Calculate integral

By the expression of \(g_{2}\left( \varpi \right)\), we have

Rearranging the first integral, we have

Rearranging the second integral, and let \({\bar{\mu }}^{2}=a^{2}+2b\hat{\Delta }^{2}/{\hat{\sigma }}^{2}\), we have

Let \(t=1/\varpi \Longrightarrow 1/t=\varpi\) and \(-\left( 1/t^{2}\right) dt=d\varpi\), hence the integral becomes

Let

we have

Note that

therefore

Moreover, we have

Therefore,

We can express the above integrand as a sum of easily integrable functions

where constants A, B, C, and D are to determined. Thus, we have

Let \(x=a\), we have

Let \(x=\sqrt{{\bar{\mu }}^{2}}\), we have

Let \(x=-\sqrt{{\bar{\mu }}^{2}}\), we have

Let \(x=0\), we have

Thus, we have

Therefore, eventually, we have

where

1.3.3 Simplified expression for ruin probability

With the expression of \(\int g\left( \varpi \right) d\varpi\), we have

Note that in a form of definite integral, we have

therefore,

Substitute it back to (23), we obtain the expression for ruin probability.

1.3.4 Derivation of optimal portfolio weight

With the expression of optimal portfolio weight in asset B, when \(P_{ww}>0,\) we have

Moreover, the absolute portfolio weight in asset B is given as \(\theta w\), hence, we have \(\lim _{w\rightarrow 0}\theta w=2k_{0}/{\hat{\Delta }}\).

1.4 Lemma 2 and Proof

Lemma 5

Given \(x=k_{0}/\varpi -\sqrt{k_{0}^{2}/\varpi ^{2}-2ak_{0}/\varpi +{\bar{\mu }}^{2} }\), and \({\bar{\mu }}^{2}=a^{2}+2b{\hat{\Delta }}^{2}/{\hat{\sigma }}^{2}\), we have \(\left( {\bar{\mu }}+x\right) /\left( {\bar{\mu }}-x\right) \sim 1/\varpi\).

Proof

We now prove \(\left( {\bar{\mu }}+x\right) /\left( {\bar{\mu }}-x\right) \sim 1/\varpi\) as \(\varpi \rightarrow \infty\) and \(x-a\sim \varpi\) as \(\varpi \rightarrow 0\). Since \(\lim _{\varpi \rightarrow \infty }x=-{\bar{\mu }}\), hence \(\lim _{\varpi \rightarrow \infty }{\bar{\mu }}-x=-2{\bar{\mu }}\). Therefore, to proof \(\frac{{\bar{\mu }}+x}{{\bar{\mu }}-x}\sim \frac{1}{\varpi }\), we only need to proof \({\bar{\mu }}+x\sim \frac{1}{\varpi }\), which is easy to see by

where

Moreover, note that

Hence, we have

and this completes the proof. □

1.5 Derivations of optimal portfolio and Bellman equation

By the dynamics of wealth (10) and by Itô’s Lemma (letting \(dt^{2}=dtdZ=0\), \(dZ^{2}=dt)\), we have

where we employ

For the optimal portfolio, M should be a martingale, hence, the drift of M should be zero, which yields the following Bellman equation as an ODE

where \({\hat{\Delta }}=\mu _{1}-\mu +\Delta\), and \({\hat{\sigma }}^{2}=\sigma _{0} ^{2}+\left( \sigma _{1}-\sigma \right) ^{2}\). Rearranging, we have

First-order condition w.r.t. \(\theta _{t}\) gives

Thus, we obtain the optimal portfolio as

where \(\phi =-\frac{\sigma \left( \sigma _{1}-\sigma \right) }{{\hat{\sigma }}^{2} }\). Substitute the optimal portfolio back to the ODE (24), we have

where

Note that

Rights and permissions

About this article

Cite this article

Karathanasopoulos, A., Lo, C.C., Ma, X. et al. Maintaining cost and ruin probability. Rev Quant Finan Acc 57, 759–793 (2021). https://doi.org/10.1007/s11156-021-00960-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-021-00960-x