Abstract

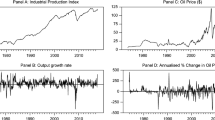

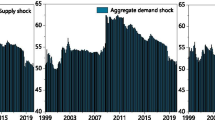

Crude oil is an essential source of energy. Without access to energy, output growth is impossible. As a result of this link, volatility in oil prices has the ability to induce fluctuations in the output of both developed and developing economies. Moreover, factors such as business cycles and policy changes often introduce nonlinearity into the transmission mechanism of oil price shocks. This study therefore examines not only the interconnectedness of oil price volatility and output growth, but also the nonlinear, asymmetric impact of oil price volatility on output growth in the countries making up the Group of Seven. To this end, monthly data on West Texas Intermediate oil price and industrial production indices of the Group of Seven countries over the period 1990:01 to 2019:08 is used for empirical analysis. The study employs the DCC and cDCC-GARCH techniques for symmetric empirical analysis. The asymmetric empirical analysis is also conducted via GJR-GARCH, FIEGARCH, HYGARCH and cDCC-GARCH techniques. The findings reveal disparities in the magnitudes of the positive and negative (asymmetric) effects of oil price shocks on output growth. The results also reveal that past news and lagged volatility have a significant impact on the current conditional volatility of the output growth of the Group of Seven countries. The study concludes that the impact of oil price volatility on output growth in the selected economies is asymmetric, the volatility is highly persistent and clustered, and the asymmetric GARCH models outperform the symmetric GARCH models.

Similar content being viewed by others

Explore related subjects

Discover the latest articles and news from researchers in related subjects, suggested using machine learning.References

Ahmed, H.J.A., Bashar, O.H., Wadud, I.M.: The transitory and permanent volatility of oil prices: what implications are there for the US industrial production? Appl. Energy 92, 447–455 (2012)

Aielli, G.P.: Consistent estimation of large scale dynamic conditional correlations (Working Paper No. 47). Department of Economics, Statistics, Mathematics, and Sociology, University of Messina, Messina (2008)

Aielli, G.P.: Dynamic conditional correlation: on properties and estimation. J. Bus. Econ. Stat. 31(3), 282–299 (2013)

Alao, R.O.: A panel cointegration approach to foreign direct investment and growth in Africa: evidences from ECOWAS, ECCAS, EAC and SADC blocs. Bus. Manag. Rev. 2(2), 66 (2012)

Alao, R.O., Alola, A.A.: The role of foreign aids and income inequality in poverty reduction: a sustainable development approach for Africa? J. Soc. Econ. Dev. 24(2), 456–469 (2022)

Alao, R.O., Payaslioglu, C.: Oil price uncertainty and industrial production in oil-exporting countries. Resour. Policy 70, 101957 (2021)

Alao, R.O., Payaslioglu, C., Alhassan, A., Alola, A.A.: Accounting for carbon dioxide emission effect of energy use, economic growth, and urbanization in the OPEC member states. Int. Soc. Sci. J. 72(243), 129–143 (2022)

Alhassan, A., Kilishi, A.A.: Analysing oil price-macroeconomic volatility in Nigeria. CBN J. Appl. Stat. 7(1), 1 (2016)

Ali, S., Zhang, J., Abbas, M., Draz, M.U., Ahmad, F.: Symmetric and asymmetric GARCH estimations and Portfolio optimization: evidence from G7 stock markets. SAGE Open 9(2), 2158244019850243 (2019)

Arouri, M.E.H., Jouini, J., Nguyen, D.K.: On the impacts of oil price fluctuations on European equity markets: volatility spillover and hedging effectiveness. Energy Econ. 34(2), 611–617 (2012)

Aydoğan, B., Tunç, G., Yelkenci, T.: The impact of oil price volatility on net-oil exporter and importer countries’ stock markets. Eurasian Econ. Rev. 7(2), 231–253 (2017)

Balcilar, M., Van Eyden, R., Uwilingiye, J., Gupta, R.: The impact of oil price on South African GDP growth: a Bayesian Markov switching-VAR analysis. Afr. Dev. Rev. 29(2), 319–336 (2017)

Balcilar, M., Usman, O., Ike, G.N.: Investing green for sustainable development without ditching economic growth. Sustain. Dev. (2022a). https://doi.org/10.1002/sd.2415

Balcilar M., Usman, O., Roubaud, D.: How do energy market shocks affect economic activity in the US under changing financial conditions? In: Applications in Energy Finance. pp. 85–114, Palgrave Macmillan, Cham (2022b)

Bollerslev, T., Mikkelsen, H.O.: Modeling and pricing long memory in stock market volatility. J. Econom. 73(1), 151–184 (1996)

Bollerslev, T., Mikkelsen, H.O.: Long-term equity anticipation securities and stock market volatility dynamics. J. Econom. 92(1), 75–99 (1999)

Brunetti, C., Gilbert, C.L.: Bivariate FIGARCH and fractional cointegration. J. Empirical Finan. 7(5), 509–530 (2000)

Cai, X., Hamori, S., Yang, L., Tian, S.: Multi-horizon dependence between crude oil and East Asian stock markets and implications in risk management. Energies 13(2), 294 (2020)

Conrad, C.: Non-negativity conditions for the hyperbolic GARCH model. J. Econom. Forthcoming, KOF Working Paper, vol. 162 (2007)

Dabwor, D.T., Iorember, P.T., Yusuf Danjuma, S.: Stock market returns, globalization and economic growth in Nigeria: evidence from volatility and cointegrating analyses. J. Public Aff. 22(2), e2393 (2022)

Davidson, J.: Moment and memory properties of linear conditional heteroscedasticity models, and a new model. J. Bus. Econ. Stat. 22(1), 16–29 (2004)

Donayre, L., Wilmot, N.A.: The asymmetric effects of oil price shocks on the Canadian economy. Int. J. Energy Econ. Policy 6(2), 167–182 (2016)

Dong, F., Li, K., Li, Y., Liu, Y., Zheng, L.: Factors influencing public support for banning gasoline vehicles in newly industrialized countries for the sake of environmental improvement: a case study of China. Environ. Sci. Pollut. Res. 29, 1–13 (2022)

Elder, J.: Oil price volatility: industrial production and special aggregates. Macroecon. Dyn. 22(3), 640–653 (2018)

Emenogu, N.G., Adenomon, M.O., Nweze, N.O.: On the volatility of daily stock returns of Total Nigeria Plc: evidence from GARCH models, value-at-risk and backtesting. Financ. Innov. 6(1), 1–25 (2020)

Engle, R.: Dynamic conditional correlation. J. Bus. Econ. Stat. 20(3), 339–350 (2002)

Filis, G., Degiannakis, S., Floros, C.: Dynamic correlation between the stock market and oil prices: the case of oil-importing and oil-exporting countries. Int. Rev. Financ. Anal. 20(3), 152–164 (2011)

Glosten, L.R., Jagannathan, R., Runkle, D.: On the relation between the expected value and the volatility of the nominal excess return on stocks. J. Finance 43, 1779–1301 (1993)

Hamilton, J.D.: Oil and the macroeconomy since World War II. J. Polit. Econ. 91(2), 228–248 (1983)

International Trade Centre [ITC] (2020) https://www.worldstopexports.com/worlds-top-export-countries/. Accessed 12 March 2021.

Iorember, P.T., Usar, T., Ibrahim, K.H.: Analyzing inflation in Nigeria: a fractionally integrated ARFIMA-GARCH modelling approach. Afr. J. Econ. Rev. 6(1), 33–46 (2018)

Jelilov, G., Iorember, P.T., Usman, O., Yua, P.M.: Testing the nexus between stock market returns and inflation in Nigeria: does the effect of COVID-19 pandemic matter? J. Public Aff. 20(4), e2289 (2020)

Jiang, Y., Jiang, C., Nie, H., Mo, B.: The time-varying linkages between global oil market and China's commodity sectors: Evidence from DCC-GJR-GARCH analyses. Energy 166, 577–586 (2019)

Lee, C.C., Olasehinde-Williams, G., Akadiri, S.S.: Are geopolitical threats powerful enough to predict global oil price volatility? Environ. Sci. Pollut. Res. 28(22), 28720–28731 (2021)

Lin, B., Wesseh, P.K., Jr., Appiah, M.O.: Oil price fluctuation, volatility spillover and the Ghanaian equity market: implication for portfolio management and hedging effectiveness. Energy Econ. 42, 172–182 (2014)

Liu, J.C.E., Chao, C.W.: Equal rights for gasoline and electricity? The dismantling of fossil fuel vehicle phase-out policy in Taiwan. Energy Res. Soc. Sci. 89, 102571 (2022)

Meckling, J., Nahm, J.: The politics of technology bans: industrial policy competition and green goals for the auto industry. Energy Policy 126, 470–479 (2019)

Mork, K.A., Olsen, Ø., Mysen, H.T.: Macroeconomic responses to oil price increases and decreases in seven OECD countries. Energy J. 15, 19–35 (1994)

Nelson, D.B.: Conditional heteroskedasticity in asset returns: a new approach. Econometrica J. Econometric Soc. 59(2), 347-370 (1991)

Ñíguez, T.M., Rubia, A.: Forecasting the conditional covariance matrix of a portfolio under long-run temporal dependence. J. Forecast. 25(6), 439–458 (2006)

OECD Data: Industrial Production Index. https://data.oecd.org/industry/industrial-production.htm (2019)

Olanipekun, I.O., Olasehinde-Williams, G.O., Alao, R.O.: Agriculture and environmental degradation in Africa: the role of income. Sci. Total Environ. 692, 60–67 (2019)

Olasehinde-Williams, G.: Is US trade policy uncertainty powerful enough to predict global output volatility? J. Int. Trade Econ. Dev. 30(1), 138–154 (2021)

Pinno, K., Serletis, A.: Oil price uncertainty and industrial production. Energy J. 34(3), 191 (2013)

Ringim, S.H., Alhassan, A., Güngör, H., Bekun, F.V.: Economic policy uncertainty and energy prices: empirical evidence from multivariate DCC-GARCH models. Energies 15(10), 3712 (2022)

Sarwar, S., Khalfaoui, R., Waheed, R., Dastgerdi, H.G.: Volatility spillovers and hedging: evidence from Asian oil-importing countries. Resour. Policy 61, 479–488 (2019)

Shahid, A., Ishfaq, M., Ahmad, M.S., Malik, S., Farooq, M., Hui, Z., Batawi, A.H., Mehmood, M.A.: Bioenergy potential of the residual microalgal biomass produced in city wastewater assessed through pyrolysis, kinetics and thermodynamics study to design algal biorefinery. Bioresour. Technol. 289, 121701 (2019)

Wajdi, M., Nadya, B., Ines, G.: Asymmetric effect and dynamic relationships over the cryptocurrencies market. Comput Secur 96, 101860 (2020)

Yang, J., Zhou, Y.: Return and volatility transmission between China’s and international crude oil futures markets: a first look. J. Futur. Mark. 40(6), 860–884 (2020)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Alao, R.O., Alhassan, A., Alao, S. et al. Symmetric and asymmetric GARCH estimations of the impact of oil price uncertainty on output growth: evidence from the G7. Lett Spat Resour Sci 16, 5 (2023). https://doi.org/10.1007/s12076-023-00325-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s12076-023-00325-z