Abstract

The pharmaceutical e-commerce market is rapidly expanding, with manufacturers and various e-commerce platforms actively exploring online pharmaceutical sales channels, while blockchain technology is introduced to ensure the transparency and authenticity of the pharmaceutical supply chain. This paper constructs a multiple channels pharmaceutical supply chain differential game model consisting of pharmaceutical manufacturer, traditional retailer and an e-commerce platform. This model explores online sales channel options for manufacturer and the impact of blockchain technology introduction on operational strategies such as pharmaceutical pricing and quality assurance inputs. The validity of the model is further confirmed through numerical examples and MATLAB simulations. The results indicate that consumer out-of-pocket percentage and preference for online channels influence the choice of online sales channel options for manufacturer. Specifically, when consumer out-of-pocket percentage or preference for online channels are low, the manufacturer should choose the reselling mode; conversely, it should choose the agency selling mode. Furthermore, the introduction of blockchain technology effectively improves both the retail price and authenticity of pharmaceuticals. This not only enhances consumer trust, but also drives market demand by enhancing the perceived quality of pharmaceuticals, thereby increasing the profitability of each supply chain member. Simultaneously, manufacturers’ investment in pharmaceutical quality assurance of pharmaceuticals have risen, which, in the long run, positively affects business growth.

Similar content being viewed by others

Introduction

The rapid growth of pharmaceutical e-commerce has increased the quantity of pharmaceutical manufacturers, such as Pfizer, Novartis, Yunnan Baiyao, Tasly, GlaxoSmithKline, etc., establishing online sales channels and implementing dual-channel sales strategies for their products1. On e-commerce platforms such as Tmall and JD.com feature both self-operated pharmacies (reselling mode) such as Ali Pharmacy and JD.com Health, and flagship stores (agency selling mode) such as Yunnan Baiyao and Tasly. However, the coexistence of multiple channels often leads to significant channel conflicts. So how to choose an appropriate dual-channel structure has become a challenging issue for pharmaceutical manufacturers.

Although online sales channels offer advantages such as reduced operational costs and enhanced consumer convenience, they also pose critical challenges regarding pharmaceutical safety2,3. In recent years, incidents involving counterfeit and illegal pharmaceuticals sold through online platforms have surged, with the global proportion of counterfeit pharmaceutical sales steadily increasing. According to the Center for Medicine in the Public Interest, the global counterfeit pharmaceutical market exceeded $75 billion in 2022, marking a 90% increase over five years, with online sales accounting for nearly 60% of counterfeit transactions4,5. This trend not only undermines consumer trust but also forces pharmaceutical companies to balance profitability with pharmaceutical safety when selecting sales channels.

Several technologies, such as barcodes, RFID tags, and sensors, are currently used to track counterfeit pharmaceuticals in the pharmaceutical supply chain. However, these solutions suffer from shortcomings, including insecurity and vulnerability to tampering6,7. Blockchain technology offers a potential solution to these issues8. More specifically, it is a decentralized distributed storage technology that is open, transparent, and tamper-proof9,10,11,12. It ensures that every link in the supply chain, from manufacturers to consumers, is recorded and verified, thereby effectively preventing counterfeiting and ensuring product quality. Therefore, the implementation of blockchain technology in the pharmaceutical supply chain not only enhances the traceability and security of pharmaceuticals but also mitigates fraud in health insurance and improves market transparency. This, in turn, helps optimize pharmaceutical pricing strategies and reduces the risks associated with quality assurance inputs13,14. Currently, there are several notable cases of blockchain technology being implemented in the pharmaceutical supply chain. Major pharmaceutical companies like Merck, GlaxoSmithKline, Pfizer, and Novartis are collaborating with Walmart to utilize blockchain technology for tracking pharmaceuticals. Additionally, JD.com Health has employed blockchain technology to enhance transparency and traceability within its supply chain15,16.

Although blockchain technology has garnered widespread attention, fully leveraging its advantages in the pharmaceutical supply chain requires close collaboration among supply chain members. Therefore, understanding the interplay between channel selection and blockchain adoption in supply chain decision-making is crucial. Existing studies primarily focus on price competition and market demand in dual-channel sales, yet they fall short in examining the impact of blockchain technology on overall supply chain coordination.

Based on this analysis, this paper aims to explore manufacturers’ online sales channel selection and the adoption of blockchain technology within the context of pharmaceutical e-commerce. The paper will address the following three questions: (1) How do manufacturers select the optimal sales model among multiple channels? (2) Under what conditions do supply chain members adopt blockchain technology? (3) How does the adoption of blockchain technology impact pharmaceutical pricing, quality assurance investment, and channel selection strategies?

To address these questions, the present research considers a multichannel supply chain consisting of a pharmaceutical manufacturer, a traditional retailer, and an e-commerce platform. State equations are used to characterize the level of pharmaceutical traceability and quality supported by blockchain. Based on this framework, differential game models are constructed for four scenarios: RN, SN, RB, and SB. This paper further investigates the interaction between manufacturer online sales channel choices and firms’ business decisions. The changes in the profits of the manufacturer, traditional retailer, and e-commerce platform are analyzed when comparing the introduction and non-introduction of blockchain technology.

The contribution of this paper is threefold. Firstly, it utilizes a dynamic game model to demonstrate the positive impact of pharmaceutical supply chain members’ adoption of blockchain technology on pharmaceutical traceability. The paper proposes that the level of pharmaceutical traceability dynamically improves as supply chain members continuously invest in the use of blockchain technology. Additionally, we explore the dynamic characteristics of pharmaceutical pricing, quality, and market demand over time. Secondly, the paper establishes a differential game model to investigate the channel selection of pharmaceutical manufacturers and the introduction of blockchain technology. This expands the research on the application of blockchain technology in the pharmaceutical supply chain and enriches the study of dual-channel selection by pharmaceutical manufacturers. Finally, the paper guides how members of the pharmaceutical supply chain can adopt blockchain technology. It offers decision-making references for promoting the construction of traceability models within the pharmaceutical supply chain and effectively contributes to the healthy and stable development of the pharmaceutical industry.

The rest of the paper is organized as follows. In section “Literature review”, briefly reviews the relevant literature; section “Problem description and assumptions” gives the problem description and basic assumptions; section “Model analysis” constructs the model and derives the equilibrium solution; section “Analysis of model results” presents the analysis of the model results; section “Numerical analysis” validates the previous conclusions by numerically analyzing the key parameters; and section “Conclusions and managerial implications” summarizes the conclusions reached in the paper and provides managerial insights.

Literature review

In this section, we review relevant literature from the following three streams: pharmaceutical supply chain, selection of multiple channel sales model, and application of blockchain in pharmaceutical supply chain.

Pharmaceutical supply chain

The pharmaceutical supply chain is a functional network centered around a core company17, primarily involving raw material suppliers, pharmaceutical manufacturers, terminal pharmaceutical sales organizations, patients and other entities18,19. Currently, numerous scholars have extensively studied the operation and management of the pharmaceutical supply chain, focusing on centralized procurement20,21, pharmaceutical quality22, pharmaceutical pricing23 and the selection between innovative and generic pharmaceuticals24,25. Among them, the most relevant studies to this paper are those on quality levels and pharmaceuticals pricing. Chen et al.26 explored the effects of different pharmaceutical quality levels on pricing by comparing the equilibrium strategies of pharmaceutical quality regulation under varying power structures. Zhou et al.27 analyzed the effects of the zero-price-added drug policy on medical service levels, medical service prices, and pharmaceutical prices by constructing a game model of the pharmaceutical supply chain, comprising pharmaceutical suppliers and public hospitals. Iacocca and Mahar28 discussed the impact of the partnership value between mail-order and pharmacy chains on pharmaceutical pricing by constructing a mathematical model. Wu et al.29 explored the impact of patients’ sensitivity to pharmaceutical prices and demand uncertainty on pharmaceutical pricing and production decisions. Yang et al.30 discussed the optimal pricing, performance, and social welfare of pharmaceuticals under price cap regulation within different power structures. Furthermore, the study by Garai & Sarkar31 demonstrated that the introduction of a closed-loop recycling mechanism in the herbal medicine supply chain helped reduce supply chain costs, improve medicine quality, and optimize resource allocation, thereby enhancing the economic efficiency of all supply chain stakeholders.

However, most of the aforementioned literature examines the operation strategies of pharmaceutical supply chain from a static perspective, fails to depict the time-varying characteristics of pharmaceutical quality, pricing, market demand, and so on. In contrast, the differential game model more accurately captures the timeliness and continuity of supply chain members’ decisions. Therefore, this paper will apply differential game theory to explore the dynamic equilibrium strategies of the pharmaceutical supply chain regarding pharmaceutical quality and pricing.

Selection of multiple channel sales model

The choice of sales channel model is a key research topic in the field of e-tailing32. Currently, many scholars have conducted in-depth research on the selection of sales channel models for different products and industries, with a primary focus on electronic products33, fresh products34,35, agricultural products27, the financial industry36, the shipping industry37 and other fields.

Meanwhile, some scholars have explored the choice of pharmaceutical dual-channel models from various perspectives. For instance, Wang and Yang38 examined the effect of consumer preferences on manufacturers’ channel selection behavior. The results indicated that an increase in consumer preference for online channels raises the demand, price, and manufacturer profitability of pharmaceutical online channels, thereby making manufacturers more likely to open online channels. Lan et al.39 investigated the impact of health insurance reimbursement system and patient preference on manufacturers’ online channel invasion, and further analyzed the effect of perceived quality of pharmaceuticals on social welfare. Huang and Wu40 explored the profitability of supply chain members and the optimal channel selection under different distribution channels, considering the impact of pharmaceutical quality and the sales efforts of pharmaceutical retailers on demand. strategies. Meanwhile, Zheng et al.41 argued that the impact of price cap policy on channel selection of pharmaceuticals should not be ignored. For this reason, they considered a two-stage supply chain consisting of pharmaceutical manufacturers and pharmacies and investigated the channel selection problem under the price cap model.

Unfortunately, most of the referenced literature primarily focuses on whether pharmaceutical manufacturers should open online channels, with less discussion on the selection of online sales channels by pharmaceutical manufacturers. Therefore, this paper will examine the choice of online sales models under the assumption that pharmaceutical manufacturers have already opened online channels.

Blockchain in the pharmaceutical supply chain

With the participation of Pfizer, Meyen Bergen, Mckesson, Premier, Walmart and others in the MediLedger blockchain pharmaceutical tracking project, the application of blockchain technology in the pharmaceutical industry has attracted widespread attention from the academic community42. Hu et al.43 were the first to establish a blockchain technology-supported vaccine supply chain management system, providing decision-making support for the management of the vaccine supply chain during the COVID-19 pandemic. Musamih et al.44 proposed an Ethereum blockchain-based method to achieve efficient product traceability in the healthcare supply chain. Moreover, despite the efforts of various international agencies to halt the trade of illegal drugs, illegal sales continue to grow. For this reason, Molina et al.45 proposed the use of blockchain technology to address traceability issues and the lack of control in the illegal drug trade.

However, most of the aforementioned studies have employed qualitative analysis, while some scholars have applied quantitative analysis to investigate the application of blockchain technology in the pharmaceutical supply chain. Niu et al.16 investigated the motivations behind the adoption of blockchain technology by pharmaceutical supply chain members and found that retailers are incentivized to participate in blockchain when the competition from manufacturers is moderate and demand variance is low. Yadav et al.46 argued that the combination of blockchain technology and the Internet of Things could address the global vaccine distribution problem, using Delphi and fuzzy decision-making experiments, along with evaluation laboratory techniques, to validate their findings. Cui et al.47 explored the impact of adopting blockchain technology on the disclosure of information regarding the quality of generic drugs competing with originator drugs in the market by constructing a game theoretic model. Nanda et al.48 proposed a new approach for integrating IoT and blockchain in the healthcare supply chain, thereby solving many of the problems faced the supply chain in the healthcare industry.

This study will employ dynamic game theory for a more in-depth analysis of whether supply chain members are willing to adopt blockchain technology and how the introduction of blockchain technology impacts their operational decision.

Problem description and assumptions

Description of the problem

This paper cites a case study on the collaboration between China Resources Pharmaceutical, Nepstar Health Pharmacy and JD.com. The case illustrates a typical pharmaceutical supply chain, comprising a pharmaceutical manufacturer(M), a traditional retailer(R), and an e-commerce platform(P). The pharmaceutical manufacturer is responsible not only for the production activities of the pharmaceutical but also for decisions such as selecting the online distribution channel, determining the level of pharmaceutical quality assurance inputs, and deciding whether to adopt blockchain. In the traditional distribution channel, the manufacturer determines the wholesale price of the pharmaceutical w, and the traditional retailer purchases the pharmaceutical from the manufacturer, sets the retail price for the offline channel\({p_1}(t)\), and considers whether to meet consumer demands for pharmaceutical traceability during sales. The online channel distinguishes between two models: in the reselling model, the e-commerce platform wholesales pharmaceuticals from the manufacturer, determines the retail price for the online channel\({p_2}(t)\), and decides whether to introduce blockchain; in the agency selling model, the e-commerce platform determines the commission rate \(\chi\) and decides whether to increase the investment in blockchain.

Based on the above analysis, this paper considers four different decision scenarios: none of the supply chain members introduce blockchain and the manufacturer adopts the reselling mode for online sales; none of the supply chain members introduces blockchain and the manufacturer adopts the agency selling mode for online sales; all of the supply chain members introduce blockchain and the manufacturer adopts the reselling mode for online sales; all of the supply chain members introduce blockchain and the manufacturer adopts the agency selling mode for online sales. In the Stackelberg differential game process, the manufacturer is the channel leader, while the traditional retailers and e-commerce platforms are the channel followers. The symbols and meanings of key parameters and decision variables are presented in Table 1.

Model assumptions

Assumption 1

The pharmaceutical manufacturer needs to take appropriate measures, such as purchasing high-quality raw materials, optimizing production processes, and establishing traceability systems, to ensure pharmaceutical quality. The model developed with reference to Nerlove & Arrow49 describes the dynamic process of change in pharmaceutical product quality:

where, \(G(t)\) denotes the quality of the pharmaceutical at moment t, \(G(t)\) denotes the initial quality of the pharmaceutical, \(R(t)\) denotes the level of the manufacturer’s quality assurance inputs, \(\lambda >0\) denotes the coefficient of influence of the quality assurance inputs on the pharmaceutical quality, and \(\delta >0\) denotes the decay coefficient of the quality of the pharmaceutical.

Assumption 2

The level of pharmaceutical traceability is determined by the level of investment in blockchain technology by supply chain members and decays over time. Based on the assumption of traceable goodwill by Liu et al.2, the pharmaceutical traceability level is described as:

where, \(Q(t)\) denotes the traceability level of the pharmaceutical at moment t, \(Q(0)\) denotes the initial pharmaceutical traceability level, and \(\alpha\) denotes the attenuation factor of the pharmaceutical traceability level. \(B_{{\text{M}}}^{{}}(t)\), \(B_{{\text{R}}}^{{}}(t)\) and \(B_{{\text{P}}}^{{}}(t)\) represent the blockchain technology investment levels of manufacturer, traditional retailer and e-commerce platform, respectively. \(\varphi >0\), \(\psi >0\) and \(\omega >0\) represent the coefficients indicating the impact of the introduction of blockchain on the level of traceability by the manufacturer, traditional retailer, and e-commerce platform, respectively.

Assumption 3

In the pharmaceutical supply chain market environment, factors such as market size, consumer out-of-pocket percentage, retail prices of pharmaceuticals, consumer traceability behaviors, and pharmaceutical quality collectively influence the demand for pharmaceuticals. The higher the level of pharmaceutical quality and traceability, the greater the market demand. In particular, it is noted that in order to express the relationship between the implementation of blockchain technology and the physical visibility of pharmaceuticals, we assume that, prior to the introduction of the blockchain, consumers spend time \(h(h>0)\)verifying the authenticity and quality of pharmaceuticals, with a probability\(\Delta (0<\Delta <1)\)that the pharmaceuticals are tested to be true. After the introduction of blockchain, consumers are able to verify the authenticity of pharmaceuticals through the blockchain and this verification process does not require almost any time delay, and the time spent at this point is \(\bar {h}(\bar {h}>0)\), and \(\bar {h}<h\). At the same time, the introduction of blockchain enhances the transparency of the entire supply chain, making it impossible for manufacturers to counterfeit pharmaceuticals and deterring retailers from selling counterfeit products, thereby ensuring the authenticity of pharmaceuticals, i.e.\(\Delta =1\).

Therefore, based on the demand assumptions proposed by Choi9, Sarkar et al.50, and Dey et al.51, we assumed that the demand functions for offline and online channels, in the absence of blockchain implementation, could be expressed as follows:

The demand functions for the offline and online channel when blockchain is introduced are:

where, \(a>0\) is the market size before the introduction of blockchain, \(\varepsilon >0\) is the market size after the introduction of blockchain, and \(a<\varepsilon <\frac{3}{2}a\) is assumed to guarantee the feasibility of the model. \(\eta >0\) is the proportion of consumers purchasing pharmaceuticals online, reflecting channel preference. \(b(0<b<1)\) denotes the proportion of consumers paying out-of-pocket for pharmaceuticals purchased through offline channels. \({p_1}(t)\) and \({p_2}(t)\) represent the unit retail prices for offline and online channels, respectively. \(\phi (0<\phi <1)\) denotes the intensity of competition between online and offline channels. Additionally, \(\tau >0\) reflects consumers’ traceability behavior, primarily the time spent by consumers on pharmaceutical testing and the sensitivity factor to pharmaceutical test results, while \(\theta >0\), \(\beta >0\) reflect the sensitivity coefficients of consumers to pharmaceutical quality and traceability levels.

Assumption 4

Referring to the assumptions of Zhang and Hezarkhani52 and Li and Chen53 regarding the cost function, the quality assurance input costs for pharmaceutical manufacturers is \({C_{\text{M}}}(R(t))\), and the blockchain technology input costs of the manufacturer, traditional retailer, and e-commerce platform are \({C_{\text{M}}}({B_{\text{M}}}(t))\), \({C_{\text{R}}}({B_{\text{R}}}(t))\) and \({C_{\text{P}}}({B_{\text{P}}}(t))\) respectively:

All the above formulas satisfy the convexity assumption54,55,where, \(\kappa >0\) denotes the manufacturer’s quality assurance input cost factor, \({\mu _1}>0\), \({\mu _2}>0\), and \({\mu _3}>0\) denote the cost factors associated with the manufacturer’s, the retailer’s, and the e-commerce platform’s introduction of blockchain technology, respectively.

Assumption 5

To better examine the manufacturer’s choice of the online channel sales model, it is assumed that the wholesale price of the pharmaceutical remains constant. In addition, the pharmaceutical manufacturer, the traditional retailer and the e-commerce platform have the same positive discount rate \(\rho\), and each operates with the objective of maximizing profit over an indefinite time horizon during time period [0, \(+\infty\)].

Model analysis

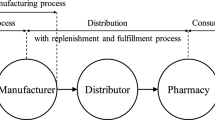

Based on the problem description and decision assumptions outlined in the previous section, this section first discusses the reselling model (RN) and the agency selling model (SN) in the absence of blockchain technology. Subsequently, the paper explores the reselling model (RB) and agency selling model (SB) with blockchain technology, deriving the optimal steady state strategies, profits, and pharmaceutical qualities of the supply chain members under four different models. The model structures for these four scenarios are illustrated in Fig. 1.

Reselling mode without blockchain (model RN)

In this scenario, both the e-commerce platform and traditional retailer purchase pharmaceuticals from the manufacturer at the same wholesale price, and independently determine retail prices. The manufacturer, traditional retailer, and e-commerce platform each aim to maximize their own profits, engaging in a Stackelberg differential game. The manufacturer first determines the wholesale price of the pharmaceutical, denoted as w. To guarantee the pharmaceutical quality, the manufacturer also determines the level of quality assurance inputs \(R(t)\). Subsequently, the traditional retailer and the e-commerce platform set their respective retail prices. The scenario is shown in Fig. 1a. Therefore, the differential game model for the three players is as follows:

In the above equation, \(J_{j}^{{{\text{RN}}}}(j=M,R,P)\) denotes the objective function of the supply chain members. The differential countermeasure model contains a state variable \(G(t)\) and a control variable \(R(t)\). By solving the optimal decision problem, the supply chain members can obtain optimal pricing and optimal quality assurance inputs to maximize the present value of profit over an infinite horizon (where the discount rate is \(\rho\)).

Proposition 1

The optimal equilibrium strategies for the manufacturer, traditional retailer and e-commerce platform in the RN scenario are

The temporal trajectory of pharmaceutical quality is \({G^{{\text{RN}}}}(t)=G_{0}^{{{\text{RN}}}}{e^{ - \delta t}}+G_{\infty }^{{{\text{RN}}}}(1 - {e^{ - \delta t}}){e^{ - \delta t}}\),\(G_{\infty }^{{{\text{RN}}}}=\frac{{w[aM+N - L(1 - \Delta +h)\tau ]\theta {\lambda ^2}}}{{\kappa \delta S(\rho +\delta )}}\) is the quality of the pharmaceutical at steady state, where\(M=\phi - \eta \phi +2b+b\eta \phi\),\(N=w[{b^2}+b{\phi ^2} - 2b+{\left( {b - \phi } \right)^2}]\),\(L=b\phi +4b+\phi\),\(S=(4b - {\phi ^2})\).

The profit function for the manufacturer, traditional retailer and e-commerce platform are\(V_{{\text{M}}}^{{{\text{RN}}}}={f_1}{G^{{\text{RN}}}}+{g_1},V_{{\text{R}}}^{{{\text{RN}}}}={f_2}{G^{{\text{RN}}}}+{g_2},V_{{\text{P}}}^{{{\text{RN}}}}={f_3}{G^{{\text{RN}}}}+{g_3}\). The values of \({f_i},{g_i}(i=1,2,3)\) and the proof procedure are shown in Supplementary Solution Process S1.

Proposition 1 states that all optimal strategies remain unchanged over time. It is evident that these decision variables are relatively static. However, the cost parameter, decay rate and discount factor negatively effect the decision variables of supply chain member. In this model, the pharmaceutical manufacturer can enhance quality assurance investments to improve pharmaceutical quality, thereby expanding demand and increasing profit.

Agency selling mode without blockchain (model SN)

In this scenario, the pharmaceutical manufacturer provides pharmaceuticals to traditional retailers at a fixed wholesale price, while the manufacturer enters the online channel, handling online sales of the pharmaceutical and paying a predefined commission rate to the platform. In this case, the e-commerce platform does not participate in the game. This situation is illustrated in Fig. 1b. Therefore, the differential game model between the manufacturer and the traditional retailer is as follows:

Proposition 2

The optimal equilibrium strategies of the traditional retailer, manufacturer under the SN model are

The mass of the pharmaceutical is\({G^{{\text{SN}}}}(t)=G_{0}^{{{\text{SN}}}}{e^{ - \delta t}}+G_{\infty }^{{{\text{SN}}}}(1 - {e^{ - \delta t}})\), \(G_{\infty }^{{{\text{SN}}}}=\frac{{[(X+2wb\phi )(X+Z\phi )+wY]\theta {\lambda ^2}}}{{\kappa \delta {S^2}(1 - \chi )(\rho +\delta )}}\), where\(X=(1 - \chi )[a[\phi (1 - \eta )+2b\eta ]+wb\phi - (\phi +2b)(1 - \Delta +h)\tau ],\) \(Y=b[(1 - \chi )[a[2(1 - \eta )+\eta \phi ]+w({\phi ^2} - 2b) - (\phi +2)(1 - \Delta +h)\tau ]+w{\phi ^2}],\) \(Z=w({\phi ^2} - 2b)\).

The profit function for the manufacturer and the traditional retailer are \(V_{{\text{M}}}^{{{\text{SN}}}}={f_4}{G^{{\text{SN}}}}+{g_4}\),\(V_{{\text{R}}}^{{{\text{SN}}}}={f_5}{G^{{\text{SN}}}}+{g_5}\) respectively. The values of \({f_i},{g_i}(i=4,5)\) and the proof procedure are shown in Supplementary Solution Process S1.

Proposition 2 indicates that in the agency selling model, the reduction of intermediate steps in pharmaceutical sales allows the manufacturer, who holds the pricing power, to attract consumers by lowering the retail price in the online channel. This strategy not only increases online demand but also promotes higher profitability. At the same time, the manufacturer should invest more in quality assurance to improve the pharmaceutical quality. Additionally, the e-commerce platform should reasonably set the commission rate to attract manufacturers to join the platform, fostering a cooperative relationship that promotes product and market development, achieving a win-win situation.

Blockchain enabled reselling mode (model RB)

The scenario is similar to the scenario RN, but the difference is that, in this model, all supply chain members can meet consumers’ demands for pharmaceutical traceability. By introducing blockchain technology, end-to-end traceability of the pharmaceutical supply chain becomes a reality, enhancing transparency across the supply chain and increasing consumer trust in pharmaceuticals. The scenario is shown in Fig. 1(c). The corresponding differential game model for the three players is as follows:

Proposition 3

Under the RB model, the optimal equilibrium strategies for the manufacturer, traditional retailer and e-commerce platform are

The mass of the pharmaceutical is\({G^{{\text{RB}}}}(t)=G_{0}^{{{\text{RB}}}}{e^{ - \delta t}}+G_{\infty }^{{{\text{RB}}}}(1 - {e^{ - \delta t}})\), \(G_{\infty }^{{{\text{RB}}}}=\frac{{w(\varepsilon M+N - L\tau \bar {h})\theta {\lambda ^2}}}{{\kappa \delta S(\rho +\delta )}}\).

The level of blockchain-enabled pharmaceutical traceability is\({Q^{{\text{RB}}}}(t)=Q_{0}^{{{\text{RB}}}}{e^{ - \alpha t}}+Q_{\infty }^{{{\text{RB}}}}(1 - {e^{ - \alpha t}})\), \(Q_{\infty }^{{{\text{RB}}}}=\frac{{w(\varepsilon M+N - L\tau \bar {h})\beta {\varphi ^2}}}{{{\mu _1}\alpha S(\rho +\alpha )}}+\frac{{b(E - 6wb)(E+2wb)\beta {\psi ^2}}}{{{\mu _2}\alpha {S^2}(\rho +\alpha )}}+\frac{{(F+wb\phi )(F - 3wb\phi )\beta {\omega ^2}}}{{{\mu _3}\alpha {S^2}(\rho +\alpha )}}\) indicates the level of pharmaceutical traceability at steady state, where\(E=\varepsilon [2(1 - \eta )+\eta \phi ]+w(\phi +{\phi ^2}) - (\phi +2)\tau \bar {h}\), \(F=\varepsilon [\phi (1 - \eta )+2b\eta ]+w({\phi ^2} - 2b) - (\phi +2b)\tau \bar {h}\).

The profit function for the manufacturer, traditional retailer and e-commerce platform are\(V_{{\text{M}}}^{{{\text{RB}}}}={f_6}{G^{{\text{RB}}}}+{h_6}{Q^{{\text{RB}}}}+{g_6}\),\(V_{{\text{R}}}^{{{\text{RB}}}}={f_7}{G^{{\text{RB}}}}+{h_7}{Q^{{\text{RB}}}}+{g_7}\),\(V_{{\text{P}}}^{{{\text{RB}}}}={f_8}{G^{{\text{RB}}}}+{h_8}{Q^{{\text{RB}}}}+{g_8}\). The values of \({f_i},{h_i},{g_i}(i=6,7,8)\) and the proof procedure are shown in Supplementary Solution Process S1.

Proposition 3 suggests that as the larger the market size increases, the greater the potential for profit and the opportunity for profit growth. Supply chain members are more motivated to invest in pharmaceutical quality and traceability. Furthermore, as the proportion of online shopping increases, e-commerce platforms are increasingly enthusiastic about technology investment. Rising costs will drive platforms to raise the retail prices for online channels, but consumers’ preference for online channels will reduce their price sensitivity, increasing online demand and improving profitability.

Blockchain enabled agency selling mode (model SB)

This scenario builds upon Scenario SN but incorporates blockchain technology. With the introduction of blockchain by the manufacturer, traditional retailer and e-commerce platform, all production information can be recorded on a blockchain platform like Ethereum. All supply chain members and consumers can access the relevant information through an app. The scenario is depicted in Fig. 1(d). Therefore, the differential game model of the three parties is as follows:

Proposition 4

Under the SB model, the optimal equilibrium strategies of the manufacturer, traditional retailer and e-commerce platform are

The mass of the pharmaceutical is \({G^{{\text{SB}}}}(t)=G_{0}^{{{\text{SB}}}}{e^{ - \delta t}}+G_{\infty }^{{{\text{SB}}}}(1 - {e^{ - \delta t}})\), \(G_{\infty }^{{{\text{SB}}}}=\frac{{\left[ {(V+2wb\phi )(V+Z\phi )+wU} \right]\theta {\lambda ^2}}}{{\kappa \delta {S^2}(1 - \chi )(\rho +\delta )}}\).

The level of blockchain-enabled pharmaceutical traceability is \({Q^{{\text{SB}}}}(t)=Q_{0}^{{{\text{SB}}}}{e^{ - \alpha t}}+Q_{\infty }^{{{\text{SB}}}}(1 - {e^{ - \alpha t}})\), \(Q_{\infty }^{{{\text{SB}}}}=\frac{{[(V+2wb\phi )(V+Z\phi )+wU]\beta {\varphi ^2}}}{{{\mu _1}\alpha {S^2}(1 - \chi )(\rho +\delta )}}+\frac{{\left\{ {(1 - \chi )[\varepsilon [2(1 - \eta )+\eta \phi ] - 2wb - (\phi +2)\tau \bar {h}]+2w{\phi ^2}} \right\}U\beta {\psi ^2}}}{{{\mu _2}\alpha {S^2}{{(1 - \chi )}^2}(\rho +\alpha )}}+\frac{{\chi (V+2wb\phi )(V+Z\phi )\beta {\omega ^2}}}{{{\mu _3}\alpha S(1 - \chi )(\rho +\alpha )}}\), where\(U=b\left\{ {(1 - \chi )[\varepsilon [2(1 - \eta )+\eta \phi ] - 2wb - (\phi +2)\tau \bar {h}]+2w{\phi ^2}} \right\}\), \(V=(1 - \chi )[\varepsilon [\phi (1 - \eta )+2b\eta ]+wb\phi - (\phi +2b)\tau \bar {h}]\).

The profit function for the manufacturer, traditional retailer, and e-commerce platform are, \(V_{{\text{M}}}^{{{\text{SB}}}}={f_9}{G^{{\text{SB}}}}+{h_9}{Q^{{\text{SB}}}}+{g_9}\), \(V_{{\text{R}}}^{{{\text{SB}}}}={f_{10}}{G^{{\text{SB}}}}+{h_{10}}{Q^{{\text{SB}}}}+{g_{10}}\),\(V_{{\text{P}}}^{{{\text{SB}}}}={f_{11}}{G^{{\text{SB}}}}+{h_{11}}{Q^{{\text{SB}}}}+{g_{11}}\). The values of \({f_i},{h_i},{g_i}(i=9,10,11)\) and the proof procedure are shown in Supplementary Solution Process S1.

Proposition 4 indicates that the pharmaceutical retail price will rise following the introduction of blockchain technology, in contrast to the scenario where blockchain without it. However, the transparency of the sales process not only enhances the traceability of the supply chain, ensuring the safety performance of the pharmaceuticals purchased by consumers, but also builds consumer trust, making them more willing to pay premium prices for pharmaceuticals. As a result, market demand for pharmaceuticals expands, leading to higher profitability for supply chain members. The pharmaceutical manufacturer is also more inclined to increase its investment in pharmaceutical quality assurance. Moreover, in the long term, the introduction of blockchain technology will further promote the development of enterprises.

Analysis of model results

In this section, we first conduct a sensitivity analysis on the relevant parameters, followed by a comparison of the optimal decisions made by the manufacturer, the traditional retailer, and the e-commerce platform across four scenarios.

Corollary 1

\(\frac{{\partial p_{1}^{{{\text{RN}}}}}}{{\partial \eta }}<0,\frac{{\partial p_{2}^{{{\text{RN}}}}}}{{\partial \eta }}>0,\frac{{\partial {R^{{\text{RN}}}}}}{{\partial \eta }}<0,\frac{{\partial V_{{\text{M}}}^{{{\text{RN}}}}}}{{\partial \eta }}<0,\frac{{\partial V_{{\text{R}}}^{{{\text{RN}}}}}}{{\partial \eta }}<0,\frac{{\partial V_{{\text{P}}}^{{{\text{RN}}}}}}{{\partial \eta }}>0,\frac{{\partial G_{{}}^{{{\text{RN}}}}}}{{\partial \eta }}<0\),\(\frac{{\partial p_{1}^{{{\text{SN}}}}}}{{\partial \eta }}<0,\frac{{\partial p_{2}^{{{\text{SN}}}}}}{{\partial \eta }}>0,\frac{{\partial {R^{{\text{SN}}}}}}{{\partial \eta }}>0,\frac{{\partial V_{{\text{M}}}^{{{\text{SN}}}}}}{{\partial \eta }}>0,\frac{{\partial V_{{\text{R}}}^{{{\text{SN}}}}}}{{\partial \eta }}<0,\frac{{\partial V_{{\text{P}}}^{{{\text{SN}}}}}}{{\partial \eta }}>0,\frac{{\partial G_{{}}^{{{\text{SN}}}}}}{{\partial \eta }}>0\)

Under the reselling channel model, the offline channel retail price of pharmaceuticals, the manufacturer’s quality assurance investment and profit, the traditional retailer’s profits and pharmaceutical quality are all negatively correlated with consumers’ preference for the online channel. Conversely, the retail price of pharmaceuticals in online channels and the e-commerce platform’s profit are both positively related to consumer preference for the online channel. This indicates that as consumers’ preference for online channels increases, there will be greater customer loss in offline channels, leading to a reduction in offline demand and putting traditional retailers at a disadvantage. To attract customers, traditional retailers will have to lower their offline retail prices. Additionally, the expansion of online pharmaceutical market demand leads e-commerce platforms to prefer increasing online pharmaceutical prices to enhance their profitability. However, the profit generated from the increase in online order volume is insufficient to offset the loss from offline sales, leading to a negative correlation with the manufacturer’s profit.

In the agency selling channel model, the retail price of pharmaceuticals in offline channels and the traditional retailer’s profit are negatively correlated with consumers’ preference for online channels. Meanwhile, the retail price of pharmaceuticals in online channels, the manufacturer’s quality assurance investment and profit, and the e-commerce platform’s profit are all positively correlated with consumers’ preference for online channels. Due to the convenience of the internet, consumers are more inclined to purchase pharmaceuticals online, increasing the online demand. As a result, the manufacturer is more inclined to raise pharmaceutical prices. At this point, both the manufacturer and the e-commerce platform are able to achieve higher profits. The manufacturer also has more funds available for optimizing production processes and establishing traceability systems, which can further improve pharmaceutical quality. Furthermore, competition between channels compels traditional retailers to adopt a low-price strategy. However, this strategy will inevitably diminish the profitability of traditional retailers.

Corollary 2

\(\frac{{\partial p_{{\text{1}}}^{{\text{i}}}}}{{\partial \tau }}<0,\frac{{\partial p_{2}^{{\text{i}}}}}{{\partial \tau }}<0,\frac{{\partial {R^{\text{i}}}}}{{\partial \tau }}<0,\frac{{\partial V_{{\text{M}}}^{{\text{i}}}}}{{\partial \tau }}<0,\frac{{\partial V_{{\text{R}}}^{{\text{i}}}}}{{\partial \tau }}<0,\frac{{\partial V_{{\text{P}}}^{{\text{i}}}}}{{\partial \tau }}<0,\frac{{\partial G_{{}}^{{\text{i}}}}}{{\partial \tau }}<0,i=RN,SN\)

Regardless of whether the manufacturer adopts the reselling or agency selling model, the pharmaceutical retail price, the quality assurance investment, supply chain members’ profits, and pharmaceutical quality are all negatively correlated with the time consumers spend on pharmaceutical inspection and the sensitivity coefficient of inspection results. This implies that the higher the sensitivity coefficient, the more consumers focus on the authenticity of the pharmaceutical, leading to higher the elastic demand for pharmaceuticals. In such cases, traditional retailers and e-commerce platforms can only gain market share by lowering the retail price to compensate for consumer dissatisfaction caused by increased inspection time or false test results. However, lower prices will lead to a reduction in profits for supply chain members, thereby decreasing investment in pharmaceutical quality assurance and resulting in lower pharmaceutical quality. In this case, supply chain members should reduce the time required for pharmaceutical testing and enhance the authenticity of pharmaceutical test results by introducing blockchain technology. This will not only improve the transparency of the supply chain and bolster consumer trust in the authenticity of pharmaceuticals, but will also facilitate the growth of market demand for pharmaceuticals. The introduction of blockchain technology will enhance the traceability of pharmaceuticals, enabling consumers to be more confident in the authenticity of the pharmaceuticals they purchase. This will encourage increased investment by manufacturers in pharmaceutical quality assurance and blockchain technology, which will improve pharmaceutical quality, further optimize pharmaceutical pricing strategies and enhance the profitability for supply chain members.

Corollary 3

\(\frac{{\partial V_{j}^{{{\text{RN}}}}}}{{\partial b}}<0,\frac{{\partial V_{j}^{{{\text{RB}}}}}}{{\partial b}}<0,\frac{{\partial V_{j}^{{{\text{SN}}}}}}{{\partial b}}<0,\frac{{\partial V_{j}^{{{\text{SB}}}}}}{{\partial b}}<0,j=M,R,P\)

The profits of the manufacturer, traditional retailer and e-commerce platform are negatively correlated with consumers’ out-of-pocket payments across the four scenarios. This is due to the impact of the national health insurance reimbursement system, where consumers, in an effort to reduce their medical expenses, are more inclined to purchase pharmaceuticals with a higher reimbursement rate. In other words, the higher the pharmaceutical reimbursement rate, the greater the market demand, which in turn increases the company’s profits. Therefore, the development and implementation of a rational health insurance reimbursement system are essential for reducing the burden on consumers and enhancing consumer satisfaction. It is also crucial for increasing the overall profitability of the supply chain and promoting the economic development of society. In addition, the pharmaceutical manufacturer must take appropriate measures to ensure the effectiveness of its pharmaceuticals to gain access to the national health insurance catalog and secure a larger market share.

Corollary 4

The relationship between the size of the manufacturer’s quality assurance inputs and the size of each member’s blockchain technology inputs for each of the four models are

\({R^{{\text{SB}}}}>{R^{{\text{SN}}}}>{R^{{\text{RB}}}}>{R^{{\text{RN}}}},B_{{\text{M}}}^{{{\text{SB}}}}>B_{{\text{M}}}^{{{\text{RB}}}},B_{{\text{R}}}^{{{\text{SB}}}}>B_{{\text{R}}}^{{{\text{RB}}}},B_{{\text{P}}}^{{{\text{RB}}}}>B_{{\text{P}}}^{{{\text{SB}}}}\)

Regardless of whether blockchain is introduced, the manufacturer is more inclined to increase its investment in pharmaceutical quality assurance under the agency selling model. This is because, under the agency selling model, the manufacturer retains control over the online pricing of the pharmaceutical and can lower the price to attract more consumers, increase demand, and expand market share, thereby gaining higher profits. Therefore, the manufacturer can invest more funds in quality assurance. Simultaneously, increasing investment in blockchain technology will better meet consumer demands for pharmaceutical traceability. Under the combined influence of the manufacturer’s technological investment and consumers’ demand for traceability, traditional retailers will likewise increase their investment in blockchain technology. As for e-commerce platform, which have more decision-making power under the reselling model, they can reasonably set the retail price of pharmaceuticals in online channels based on the wholesale price, expand demand for online channels, improve their own profitability, and increase the investment in blockchain technology.

Numerical analysis

Due to the complexity of the model, some properties and results are difficult to derive. In this section, we will further analyze the factors influencing manufacturer’s channel choices, the conditions for introducing blockchain technology, and its impact on the operational strategies of each member through numerical examples. We discuss and analyze key parameters, including the consumer’s percentage, channel preferences and their sensitivity coefficients to pharmaceutical testing time and results. Based on the relevant theories of Liu et al.2, Niu et al.16 and Wen & Liu56, as well as the actual operational conditions of the pharmaceutical industry, the fundamental parameter settings in this study are as follows: w =5, a = 20, \(\varepsilon\)= 25, b = 0.4, \(\chi\)= 0.1, \(\eta\)= 0.4, h = 1, \(\bar {h}\)=0.5, \(\Delta\)= 0.6, \(\tau\)= 0.3, \(\rho\)= 0.3, \(\lambda\)= 0.6, \(\varphi\)= 0.5, \(\omega\)= 0.5, \(\psi\)= 0.5, \(\theta\)= 0.7, \(\beta\)= 0.5, \(\kappa\)= 1, \({\mu _1}={\mu _2}={\mu _3}\)=2, \(\delta\)= 0.2, \(\alpha\)= 0.3, \(\phi\)= 0.4. To ensure the feasibility of the optimal strategy in the model, the consumers preference for online channels varies within the range of [0,0.8] according to the basic parameters set in the model.

Factors influencing manufacturers’ channel selection

Figure 2 illustrates the impact of consumer out-of-pocket percentage on members profits. (1) Under all four models, the profits of each supply chain member decrease as the consumer out-of-pocket percentage increases. This suggests that the smaller the health insurance reimbursement rate, the more unfavorable it is for the manufacturer, traditional retailer, and e-commerce platform. When purchasing pharmaceuticals, consumers are more inclined to choose those included in the national health insurance catalog with a higher reimbursement rate. (2) Currently, health insurance reimbursements are still predominantly made through offline channels, which limits consumers’ preference for purchasing pharmaceuticals online. The preference for offline channels will increase the market demand for traditional pharmaceuticals, improving the competitiveness and profitability of traditional retailers, thus affecting online channel sales to some extent. (3) Regardless of whether blockchain technology is introduced, manufacturers always prefer reselling mode when consumer out-of-pocket percentage is below a certain threshold and the agency selling mode when it exceeds a certain threshold. Because of the influence of health insurance payment policy, the higher the proportion of health insurance reimbursement, the more consumers are inclined to purchase pharmaceuticals offline, which reduces the demand for online channels. As a result, manufacturer have less incentive to invest int online channels and are more inclined to choose the reselling mode. When the reimbursement rate is lower, or when certain pharmaceuticals require full payment from consumers, offline channels lose their payment advantage, while online retail prices are lower, leading to an increase in online pharmaceutical market demand. At this point, the manufacturer prefers to control the online retail channel themselves in order to maximize profit, thus favoring the agency reselling model.

Figure 3 shows the impact of consumer preferences for online channels on member profits. (1) In the reselling model, the manufacturer’s profit decreases as consumer preference for the online channel increases. In contrast, in the agency selling model, the manufacturer’s profit increases with a higher consumer preference for the online channel. Furthermore, in all four scenarios, the profit of the traditional retailer consistently decreases as consumer preference for online channels increases, while the profit of the e-commerce platform steadily increases with the growing consumer preference for online channels. (2) For the manufacturer, when consumer preference for online channels is relatively low, the demand for online channels and the profits of retailers in online channels are also low. At this point, the manufacturer is reluctant to invest significant manpower and resources in online pharmaceutical sales, and thus tends to opt for the reselling model. Otherwise, they tend to opt for the agency selling model. (3) For the traditional retailer, as consumer preference for online channels increases, the number of customers lost in offline retail channels continues to rise. Even with a reduction in retail prices, the profits gained by traditional retailers still show negative growth. (4) E-commerce platforms, on the other hand, experience the opposite effect: the more consumers buy online, the greater the demand for online pharmaceuticals, and the more profit the e-commerce platform gains.

Conditions and implications of the introduction of blockchain technology

Figure 4 shows the impact of consumer sensitivity coefficients to time spent on pharmaceutical tests and test results on pharmaceutical pricing. (1) The price of pharmaceuticals after the introduction of blockchain technology is higher than the case without blockchain technology. Moreover, both offline and online retail prices show a decreasing trend due to the impact of the sensitivity factor. (2) In the absence of blockchain technology, the retail price of pharmaceuticals decreases more significantly. This suggests that, influenced by pharmaceutical safety incidents, consumers pay more attention to the quality of the pharmaceuticals they purchase and are more willing to spend time and money to verify the quality. As consumer sensitivity increases, retailer lower prices to compensate for the dissatisfaction caused by this, which also encourages supply chain members to introduce blockchain technology in order to meet consumers’ demand for traceability. (3) In the case of the introduction of blockchain technology, the retail price of pharmaceuticals decreases to a lesser extent. This is because the introduction of blockchain can reduce the harm caused to consumers by counterfeit pharmaceuticals and weaken the sensitivity of prices to the traceability behavior of consumers. At the same time, due to the increase in costs, members will appropriately increase the price of pharmaceuticals to maintain their profitability.

Figure 5 shows the impact of the sensitivity factor of consumers to the time spent on pharmaceutical testing and test results on the profitability of each member. (1) The manufacturer and traditional retailer achieve the largest profits in model SB and the lowest in model RN; the e-commerce platform achieves the largest in model RB and the lowest in model SN. Furthermore, the profit of the manufacturer, traditional retailer, and e-commerce platform decreases to varying degrees as consumer sensitivity to the time wasted on pharmaceutical inspection and the results of the inspection increases. The magnitude of change is larger in model RN and model SN, and smaller in model RB and model SB. (2) In the absence of blockchain technology, consumers face difficulty in obtaining detailed information about the pharmaceuticals, and the quality of the pharmaceuticals cannot be guaranteed, which leads to a decrease in trust toward the supply chain members. In order to retain existing consumers, members can only lower the price of the pharmaceuticals, a measure that significantly reduces their profitability. (3) When blockchain technology is introduced, consumers can easily and quickly access detailed information about the pharmaceuticals, ensuring the high quality of the products. This increases consumer satisfaction, boosts the demand for pharmaceuticals in the market, and improves profitability. Furthermore, the transparency of the sales channel reduces the impact of the sensitivity factor on members.

Figure 6 shows the impact of the sensitivity factor of consumers to the time spent on pharmaceutical testing and test results on the quality and traceability level of pharmaceuticals. (1) In all four models, the state variables are influenced by the equilibrium strategy and gradually stabilize over time, indicating the global asymptotic stability of these variables. (2) In Fig. 6(a), the quality of the pharmaceuticals obtained with the introduction of the blockchain technology is consistently higher than that in the same model without blockchain technology. This indicates that the introduction of blockchain technology has a positive effect on improving pharmaceutical quality. The pharmaceutical supply chain becomes more transparent, the circulation process is more strictly regulated, and information sharing is more efficient after the introduction of blockchain technology. Therefore, pharmaceutical manufacturers should take measures to improve pharmaceutical quality and ensure their efficacy. (3) In Fig. 6(b), the traceability level of pharmaceutical is higher in the agency selling mode than in the reselling mode. As seen in Fig. 5, when all supply chain members introduce blockchain technology, both the manufacturer and the traditional retailer can achieve profit maximization the agency selling mode, so both are more willing to invest in blockchain technology, and the higher the level of pharmaceutical traceability. At this point, the manufacturer and the traditional retailer are reluctant to invest in blockchain technology, which makes it difficult to improve the level of pharmaceutical traceability.

Conclusions and managerial implications

This paper investigates a multiple channel pharmaceutical supply chain consisting of a pharmaceutical manufacturer, a traditional retailer and an e-commerce platform in a dynamic environment. It focuses on analyzing supply chain members’ channel selection, the decision-making process for adopting blockchain technology, and the impact of blockchain integration on pharmaceutical pricing, quality assurance investments, and the profitability of each member.

Conclusions

First, consumers’ out-of-pocket ratio and preference for online channels significantly influence manufacturers’ choices of online sales models. Numerical analysis results indicate that, regardless of whether blockchain technology is adopted, manufacturers tend to prefer the reselling mode when the out-of-pocket ratio falls below a certain threshold. Conversely, when this ratio exceeds the threshold, they are more inclined toward the agency selling mode. Additionally, when consumers exhibit a lower preference for online channels, manufacturers are more likely to adopt the reselling mode; otherwise, they tend to favor the agency selling mode.

Secondly, blockchain technology enhances transparency and information authenticity in the pharmaceutical supply chain by providing a reliable platform for pharmaceutical traceability and anti-counterfeiting. This effectively reduces the risks posed by counterfeit pharmaceuticals to consumers and strengthens consumer trust. Therefore, for supply chain participants, adopting blockchain technology serves as an effective strategy to address current pharmaceutical challenges, improve the supply chain environment, and enhance safety management. The decision to implement blockchain technology depends on consumers’ sensitivity to the time spent on pharmaceutical inspections and the reliability of inspection results. In an era of material abundance and advanced information technology, consumer demand for pharmaceutical quality and safety continues to rise, leading to an increasing sensitivity coefficient. As a result, pharmaceutical supply chain members should proactively adopt blockchain technology to enhance transparency, authenticity, and trust across the entire industry.

Finally, the study finds that while the adoption of blockchain technology leads to an increase in pharmaceutical retail prices, its negative impact can be partially offset by the enhanced safety and credibility it provides, given consumers’ high sensitivity to inspection time and results. When the sensitivity coefficient is high, the short-term cost and investment pressure associated with blockchain implementation may be substantial. However, in the long run, such investments significantly stimulate market demand for pharmaceuticals and improve the profitability of supply chain members. Furthermore, with increased profits, manufacturers can allocate more resources to quality assurance initiatives, continuously improving pharmaceutical quality and efficacy while minimizing side effects. This, in turn, better meets consumer demand for high-quality pharmaceuticals and strengthens overall trust in the supply chain.

Managerial implications

For pharmaceutical manufacturers, in addition to strictly controlling the quality of pharmaceuticals, continuous innovation and the evaluation of actual effects are also crucial, especially in the application of blockchain technology. Given the growing consumer concern about the authenticity of pharmaceuticals, manufacturers should increase their investment in blockchain technology to enhance the traceability and quality assurance of their products, thereby boosting consumer trust and reducing risks associated with pharmaceutical quality issues. At the same time, with the rapid development of online sales channels, manufacturers need to promptly assess consumer channel preferences and market demand, and adjust their sales models flexibly, avoiding reliance on traditional sales methods to better adapt to market changes.

For traditional retailers, facing the encroachment of e-commerce platforms in the pharmaceutical market, they should fully leverage the advantages of offline channels, particularly by offering unique value in health insurance payments to attract more consumers. Additionally, retailers need to gain a deeper understanding of the sales strategies of their online competitors and adjust their business models flexibly in response to market changes. Moreover, to enhance market competitiveness, retailers should actively adopt blockchain technology to ensure the traceability and transparency of pharmaceuticals, further boosting consumer trust and reducing customer loss due to counterfeit pharmaceuticals.

For e-commerce platforms, the pharmaceutical e-commerce industry is currently in a rapid development phase, making in-depth cooperation between platforms and manufacturers particularly crucial. Therefore, e-commerce platforms should reasonably set commission fees based on market demand and actively promote the application of blockchain technology, ensuring collaboration with manufacturers and retailers to fully realize the value of blockchain technology. At the same time, platforms can enhance their credibility through this technology, thereby increasing consumer trust and boosting the platform’s competitiveness.

Future research directions

This study has certain limitations and possibilities for further research. First, we assumed that the health insurance payment policy applies solely to offline channels; however, some regions in China allow health insurance payments for pharmaceuticals purchased online. Future research could explore scenarios where health insurance reimbursement applies to pharmaceuticals purchased through both online and offline channels. Second, we assumed that supply chain members introduced blockchain technology through direct investment, but this approach may increase the risk to the firm. Future research could explore the option of introducing the technology through participation in a blockchain cooperative alliance or platform. Finally, the impact of blockchain technology on both consumer and social sustainability could be further explored in future research, particularly in relation to consumer surplus and social welfare.

Data availability

The datasets used and/or analyzed during the current study available from the corresponding author on reasonable request. All data generated or analyzed during this study are included in this published article and [its supplementary information files].

References

Li, S. et al. Pricing of medical services and channel selection strategies for pharmaceutical supply chain under the zero-markup drug policy. Manage. Decis. Econ. 45 (8), 5883–5898 (2024).

Liu, Y., Ma, D., Hu, J. & Zhang, Z. Sales mode selection of fresh food supply chain based on blockchain technology under different channel competition. Comput. Ind. Eng. 162, 107730 (2021).

Mahapatra, A. S., Sengupta, S., Dasgupta, A., Sarkar, B. & Goswami, R. T. What is the impact of demand patterns on integrated online-offline and buy-online-pickup in-store (BOPS) retail in a smart supply chain management? J. Retail Consum. Serv. 82, 104093 (2025).

Liu, S., Zhang, R., Liu, C. & Shi, D. P-PBFT: an improved blockchain algorithm to support large-scale pharmaceutical traceability. Comput. Biol. Med. 154, 106590 (2023).

Hastig, G. M. & Sodhi, M. S. Blockchain for supply chain traceability: business requirements and critical success factors. Prod. Oper. Manag. 29, 935–954 (2020).

Sarkar, B., Tayyab, M., Kim, N. & Habib, M. S. Optimal production delivery policies for supplier and manufacturer in a constrained closed-loop supply chain for returnable transport packaging through metaheuristic approach. Comput. Ind. Eng. 135, 987–1003 (2019).

Sarkar, B. & Bhuniya, S. A sustainable flexible manufacturing-remanufacturing model with improved service and green investment under variable demand. Expert Syst. Appl. 202, 117154 (2022).

Abdallah, S. & Nizamuddin, N. Blockchain-based solution for pharma supply chain industry. Comput. Ind. Eng. 177, 108997 (2023).

Choi, T. M. Blockchain-technology-supported platforms for diamond authentication and certification in luxury supply chains. Transp. Res. Part. E Log. Trans. Rev. 128, 17–29 (2019).

Zhong, Y., Yang, T., Yu, H., Zhong, S. & Xie, W. Impacts of blockchain technology with government subsidies on a dual-channel supply chain for tracing product information. Transp. Res. Part. E Log. Trans. Rev. 171, 103032 (2023).

Zhang, T., Dong, P., Chen, X. & Gong, Y. The impacts of blockchain adoption on a dual-channel supply chain with risk-averse members. Omega 114, 102747 (2023).

Saxena, N. & Sarkar, B. How does the retailing industry decide the best replenishment strategy by utilizing technological support through blockchain? J. Retail Consum. Serv. 71, 103151 (2023).

Gomasta, S. S., Dhali, A., Tahlil, T., Anwar, M. M. & Ali, A. B. M. S. PharmaChain: Blockchain-based drug supply chain provenance verification system. Heliyon 9 (7), 17957 (2023).

Nabli, H., Ghannem, A., Djemaa, R. B. & Sliman, L. How innovative technologies shape the future of pharmaceutical supply chains. Comput. Ind. Eng. 199, 110745 (2025).

Ghadge, A., Bourlakis, M., Kamble, S. & Seuring, S. Blockchain implementation in pharmaceutical supply chains: A review and conceptual framework. Int. J. Prod. Res. 61, 6633–6651 (2022).

Niu, B., Dong, J. & Liu, Y. Incentive alignment for blockchain adoption in medicine supply chains. Transp. Res. Part. E Log. Trans. Rev. 152, 102276 (2021).

Shi, J., Yi, D. & Kuang, J. Pharmaceutical supply chain management system with integration of IoT and blockchain technology. Lect Notes Comput. Sci. 10, 97–108 (2019).

Goodarzian, F., Kumar, V. & Ghasemi, P. A set of efficient heuristics and meta-heuristics to solve a multi-objective pharmaceutical supply chain network. Comput. Ind. Eng. 158, 107389 (2021).

Xia, Y., Li, J. & Zhang, Z. Effects of price cap regulation on pharmaceutical supply chain under the zero markup drug policy. Oper. Res. 23 (4), 56 (2023).

Parmaksiz, K., van de Bovenkamp, H. & Bal, R. Does structural form matter? A comparative analysis of pooled procurement mechanisms for health commodities. Glob Health. 19 (1), 90 (2023).

Parmaksiz, K., Pisani, E., Bal, R. & Kok, M. O. A systematic review of pooled procurement of medicines and vaccines: identifying elements of success. Glob Health. 18 (1), 59 (2022).

Diriba, G., Hasen, G., Tefera, Y. & Suleman, S. Assessment of the magnitude and contributing factors of expired medicines in the public pharmaceutical supply chains of Western Ethiopia. BMC Health Serv. Res. 23 (1), 791 (2023).

Lu, Q. et al. Pricing strategy research in the dual-channel pharmaceutical supply chain considering service. Front. Public. Health. 12, 1265171 (2024).

Jayachandran, P. Advances in quantitative methods and modeling for complex generic drugs and opportunities to hybridize learnings between innovator and generic drug developers. CPT: Pharm. Syst. Pharm. 12, 549–551 (2023).

Liu, Q., Huang, Z. & Mao, Z. Has the consistency evaluation policy of generic drugs promoted the innovation quality of Chinese pharmaceutical manufacturing industry? An empirical study based on the difference-in-differences model. Front. Public. Health. 11, 125756 (2023).

Chen, X., Li, S. & Wang, X. Evaluating the effects of quality regulations on the pharmaceutical supply chain. Int. J. Prod. Econ. 230, 107770 (2020).

Zhou, N., Li, S., Zhao, G., Li, C. & Yu, N. Medical service pricing and pharmaceutical supply chain coordination contracts under the zero-markup drug policy. Front. Public. Health. 11, 1208994 (2023).

Iacocca, K. M. & Mahar, S. Cooperative partnerships and pricing in the pharmaceutical supply chain. Int. J. Prod. Res. 57, 1724–1740 (2018).

Wu, S., Luo, M., Zhang, J., Zhang, D. & Zhang, L. Pharmaceutical supply chain in China: pricing and production decisions with price-sensitive and uncertain demand. Sustainability 14 (13), 7551 (2022).

Yang, X., Liu, L., Zheng, Y., Yang, X. & Sun, S. Pricing problems in the pharmaceutical supply Hain with mixed channel: A power perspective. Sustainability 14 (12), 7420 (2022).

Garai, A. & Sarkar, B. Economically independent reverse logistics of customer-centric closed-loop supply chain for herbal medicines and biofuel. J. Clean. Prod. 334, 129977 (2022).

Xiao, M., Gu, Q. & He, X. Selection of sales mode for e-commerce platform considering corporate social responsibility. Systems 11 (11), 543 (2023).

Zhang, C., Li, Y. & Ma, Y. Direct selling, agent selling, or dual-format selling: electronic channel configuration considering channel competition and platform service. Comput. Ind. Eng. 157, 107368 (2021).

Choi, J., Jang, S. & Choi, J. Y. Determinants of selection behavior in online distribution channels for fresh food. Int. J. Consum. Stud. 46, 2318–2332 (2022).

Yadav, J., Wang, D., Tian, X. & Guo, M. Pricing decision and channel selection of fresh agricultural products dual-channel supply chain based on blockchain. Plos One 19(3), e0297484 (2024).

Dong, C., Huang, Q. & Fang, D. Channel selection and pricing strategy with supply chain finance and blockchain. Int. J. Prod. Econ. 265, 109006 (2023).

Peng, Q. & Wang, C. Dynamic evolutionary game and simulation with embedded pricing model for channel selection in shipping supply chain. Appl. Soft Comput. 144, 110519 (2023).

Wang, W. & Yang, W. Research on Drug Supply Chain Channel Strategies Considering Consumer Preferences and Medical Insurance Proceedings of the 5th International Conference on Economic Management and Model Engineering, ICEMME 2023, November 17–19, 2023, Beijing, China.

Lan, Y., Lu, P., Pan, C., Kar, S. & Li, W. The effects of medical insurance and patients’ preference on manufacturer encroachment in a pharmaceutical supply chain. J. Manag Sci. Eng. 7, 243–265 (2022).

Huang, L. & Wu, Y. Research on coordination of a pharmaceutical dual-channel supply chain considering pharmaceutical product quality and sales efforts. Open. J. Soc. Sci. 10, 297–328 (2022).

Zheng, Y. et al. Price Cap Models in pharmaceutical online-to-offline supply chains. Complexity. 1–16 (2020).

Liu, X., Barenji, A. V., Li, Z., Montreuil, B. & Huang, G. Q. Blockchain-based smart tracking and tracing platform for drug supply chain. Comput. Ind. Eng. 161, 107669 (2021).

Hu, H., Xu, J., Liu, M. & Lim, M. K. Vaccine supply chain management: an intelligent system utilizing blockchain, IoT and machine learning. J. Bus. Res. 156, 113480 (2023).

Musamih, A. et al. A blockchain-based approach for drug traceability in healthcare supply chain. IEEE Access. 9, 9728–9743 (2021).

Molina, J. C., Delgado, D. T. & Tarazona, G. Using blockchain for traceability in the drug supply chain. Commun. Comput. Inf. Sci. 46, 536–548 (2019).

Yadav, A. K., Kumar, D. & Shweta & Blockchain technology and vaccine supply chain: exploration and analysis of the adoption barriers in the Indian context. Int. J. Prod. Econ. 255, 108716 (2023).

Cui, Z., Liu, X., Feng, Z. & Huang, Z. Blockchain adoption for generic drugs in the medicine supply chain with consumers’ risk-aversion: A aame-theoretic model within Chinese legal framework. Risk Manag Healthc. Policy. 17, 15–28 (2024).

Nanda, S. K., Panda, S. K. & Dash, M. Medical supply chain integrated with blockchain and IoT to track the logistics of medical products. Tools Appl. 82, 32917–32939 (2023).

Nerlove, M. & Arrow, K. J. Optimal advertising policy under dynamic conditions. Economica 29, 129–142 (1962).

Sarkar, B., Debnath, A., Chiu, A. S. F. & Ahmed, W. Circular economy-driven two-stage supply chain management for nullifying waste. J. Clean. Prod. 339, 130513 (2022).

Dey, B. K., Bhuniya, S. & Sarkar, B. Involvement of controllable lead time and variable demand for a smart manufacturing system under a supply chain management. Expert Syst. Appl. 184, 115464 (2021).

Zhang, Y. & Hezarkhani, B. Competition in dual-channel supply chains: the manufacturers’ channel selection. Eur. J. Oper. Res. 291, 244–262 (2021).

Li, W. & Chen, J. Pricing and quality competition in a brand-differentiated supply chain. Int. J. Prod. Econ. 202, 97–108 (2018).

Song, J., Chutani, A., Dolgui, A. & Liang, L. Dynamic innovation and pricing decisions in a supply-Chain. Omega 103, 102423 (2021).

Sarkar, B., Omair, M. & Kim, N. A cooperative advertising collaboration policy in supply chain management under uncertain conditions. Appl. Soft Comput. 88, 105948 (2020).

Wen, Y. & Liu, L. Comparative study on low-carbon strategy and government subsidy model of pharmaceutical supply chain. Sustainability 15, 8345 (2023).

Acknowledgements

The authors are very grateful to anonymous reviewers and editors for their helpful comments and suggestions, which have greatly improved the quality of this paper.

Funding

This work was supported by the Natural Science Foundation of Shandong Province (ZR2019MG001).

Author information

Authors and Affiliations

Contributions

Y.W. and L.L. proposed the research idea, Y.W. solved the model and prepared a draft, Y.W. revised the manuscript and all authors commented on previous versions of the manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Wen, Y., Wei, Y. & Liu, L. Research on operation strategy of multiple channels pharmaceutical supply chain based on blockchain technology. Sci Rep 15, 17033 (2025). https://doi.org/10.1038/s41598-025-00727-7

Received:

Accepted:

Published:

DOI: https://doi.org/10.1038/s41598-025-00727-7