Abstract

The notable rise in carbon emissions has profoundly affected humanity’s sustainable development. Achieving the "dual-carbon" goal requires understanding how enterprises can effectively reduce their carbon footprint. To elucidate the dynamic correlation of environmental regulation, corporate technological innovation, and corporate carbon emissions, this study employs a Panel Vector Autoregression model to analyze data from listed firms between 2005 and 2021, using GMM regression, impulse response analysis, and variance decomposition. The key findings are: (1) Environmental regulation, corporate technological innovation, and corporate carbon emissions exhibit self-reinforcing mechanisms, though the effect weakens over time. (2) Environmental regulation reduces corporate carbon emissions significantly, and this effect is partially mediated through corporate technological innovation. (3) A bidirectional relationship exists between corporate technological innovation and corporate carbon emissions, where corporate technological innovation has a stronger positive effect on reducing corporate carbon emissions. (4) Environmental regulation promotes corporate technological innovation, while corporate technological innovation gradually mitigates the stringency of environmental regulation. The findings herein offer actionable insights for enterprises to adopt cleaner production strategies and offer a scientific basis for policymakers to enhance environmental regulations in pursuit of a low-carbon economy.

Similar content being viewed by others

Introduction

Global warming is a widely recognized issue on a worldwide scale1,2. To address this challenge, governments and organizations have taken measures to alleviate and postpone environmental deterioration3. The Paris Agreement of 2015, adopted by 178 nations, creates a durable framework for global endeavors to cope with the issue of climate change4. Recognized as a prominent global manufacturing hub, China has made significant strides in enhancing its industrial chain and expanding its manufacturing processing capacity. Still, this progress has resulted in accelerated carbon emissions (CE), and based on the data from the Global Carbon Atlas (GCA), China’s cumulative carbon dioxide (CO2) emissions experienced a significant increase from 799 million metric tons (Mt) in 1963 to 11,903 Mt in 2023 for a substantial growth of 1,390%, positioning the nation as the leading emitter globally. It can be seen that the alignment between its economic development and environmental capability is inadequate5. As a responsible emerging nation, China declared during the 75th session of the United Nations General Assembly in 2020 its commitment to accomplish the “dual carbon” goal by 2030 and 2060, as outlined in Objective 3060.

Tanthanongsakkun et al.6 emphasized that corporations contribute significantly to global greenhouse gas emissions. As shown on the "Carbon Emission Ranking of Listed Companies in China (2024)", CE from listed companies in China for 2023 will amount to approximately 5.161 billion tons, representing a share of about 41% of the overall emissions. It’s well-documented that significant CE may jeopardize a company’s value7. To effectively tackle global warming, enterprises that serve as the primary drivers of economic activities need to reduce their emissions8. Chen et al.9 and Chen10 both pointed out that as stakeholders in carbon emission reductions and trading, firms are pivotal in advancing a low-carbon economy. Of the many means of reducing emissions, technological innovation (TI) presents a significant potential for companies11, which cuts CE by tackling resource and environment limitations.

According to Dwivedi et al.12, technology is pivotal in achieving net-zero emissions globally. Green technology innovations can optimize energy efficiency and boost profits13. Chang et al.4 assert that implementing green technology innovation constitutes an effective strategy to mitigate environmental damage. They further emphasize the significance of governmental intervention in augmenting the efficacy of TI. One explanation for this phenomenon is that corporate environmental governance behavior generates positive externalities. Despite incurring significant governance costs, corporations can’t reap the benefits independently. As a result, corporations are inclined to prioritize profit over environmental benefits without constraints14. Alternatively, they may engage in some “greenwashing” activities15, which refers to the deliberate exaggeration or misrepresentation of environmental behavior by companies16. Therefore, the environmental regulation (ER) is essential.

Based on that, the current paper believes a strong link exists between ER, corporate technological innovation (CTI), and corporate carbon emissions (CCE). Therefore, this study employed the Panel Vector Autoregression (PVAR) model with GMM regression to examine the static correlations of them. It subsequently investigates the dynamic correlations via the impulse response model. After that, we ultimately assess the contribution of various disturbances to the fluctuations of core variables through variance decomposition. The elucidation of the interconnections among the three factors is essential for improving business competitiveness, meeting national carbon emission reductions goals, and promoting sustainable human development.

In contrast to the related literature, the present research contributes in the following areas. (1) The assessment of ER involves word division processing using R software, which is founded on the text analysis approach of local Government Work Reports. The level of regulation is then measured by counting the frequency of environmental protection-related words. Compared to unitary indicators such as the ecological investment ratio and traditional pollution control costs, the Government Work Report can provide an objective and comprehensive response to the regional regulatory level, mitigating the endogeneity issue with traditional measurement indicators. (2) This study uses the PVAR model to confirm the Interaction between ER, CTI and CCE. Most current research assesses the unidirectional association between the two variables instead of the interactive effect of the three, potentially resulting in cognitive bias. (3) China is a developing economy, and synergistic development of the environment and economy is critical. Consequently, Chinese scholars have undertaken extensive research into CE. Nonetheless, most focus on the meso-level, utilizing provincial panel data as observational samples to analyze the determinants affecting the economic effects of CO2 emissions, rarely investigated from the company perspective.

The following parts of the paper are structured as outlined below. Section "Literature review" presents the notion of core variables, literature review, and theoretical mechanism. Section "Methodology" delineates the approach, variables, and the data selection process. Section "Empirical analysis" displays the empirical findings. Section "Conclusions" offers a thorough summary of the conclusions. Section "Policy recommendations and future directions" presents the policy recommendations and future directions.

Literature review

Environmental regulation and corporate carbon emissions

ER refers to the limits imposed by the government on environmental stakeholders, serving as a sort of social regulation that mitigates polluting behaviors through prohibitions, environmental levies, and subsidies for clean energy, with the aim of achieving integrated economic and environmental development. The majority of research on the effect of ER on CE targets the meso-level, which can be categorized into the following views.

Some scholars believe that ER could effectively monitor the environment17, constrain the polluting behavior of enterprises18, and create a "back-forced emission reduction." Kou et al.19 propose that informal-ER will mitigate corruption, thereby decreasing CO2 emissions. Gu et al.20 examine prefecture-level cities in China and assert that carbon market policy, as a kind of environmental management, facilitates the reduction of urban energy use. Xiao et al.21 indicated that while there are advantages, the environmental tax will mitigate the adverse impact of CO2, albeit at the cost of certain economic factors. Liao et al.22 argued that ER favors the synergistic emission reduction of CO2 and atmospheric pollutants but is affected by the regional economy level. Khan et al.23 point out that ER inhibits the growth of carbon emissions in both the long and short term.

Conversely, some academics argue that ER increases CE. Sinn24 introduces the idea of the "green paradox," which holds that measures taken by the Government to combat climate change cause the consumption of petrochemical energy to increase, raising greenhouse gas emissions and ultimately worsening the environment. Sinn24 contends that due to the pessimism of fossil energy proprietors over future energy laws, they proceed with their extraction initiatives to circumvent more stringent rules. In addition, the abundant supply will allow prices to decrease, which will, in turn, stimulate greater demand and result in a quick surge in carbon, referred to as the green paradox. The green paradox discloses that "good motivation does not always cause good behavior effect"25,26. According to Wang & Wei27, strict environmental rules may lead to an increase of carbon emissions in emerging economies. Baloch et al.28 examine the nations of BRICS, where ER stimulates carbon emissions that worsen the ecosystem. Cao et al.29 also point out that ER shows significant negative impacts in the western of China.

Furthermore, others advocate for the inverted U-shaped relationship30, N-shaped relationship31, threshold effect32, and cyclical link2 between ER and CE. Certain experts contend that ER is superfluous, asserting that a decrease in natural resources correlates with a reduction in CE. The influence of ER on CE remains ambiguous due to the dual roles of "back-forced emission reduction" and "green paradox." The reasons for this are that many factors drive CE, and the effect of ER on CE may be last-long. Simultaneously, when CE reaches excessive levels, governments may be compelled to implement more stringent ER to combat climate change due to international and popular pressure. Consequently, the dynamics and intricacies of the link between ER and CE require further investigation.

Environmental regulation and corporate technological innovation

One well-balanced primary notion for leading the shift to a low-carbon development pattern is innovation2. However, Rennings33 suggests that eco-innovation has double externalities, i.e. knowledge spillovers and environmental spillovers. The former refers to the situation where R&D firms find it hard to fully internalize the benefits of innovation due to the fact that some firms can benefit from imitation or diffusion without incurring R&D costs. And the latter refers to the fact that although investment in environmental optimization related to R&D can create environmental benefits for society as a whole, it is difficult for enterprises to directly convert it into economic profits. This results in insufficient motivation for enterprise eco-innovation, causing market failure, which necessitates government intervention through instruments to promote it33. The same applies to technological innovation. Many empirical studies indicate a strong correlation between ER and TI34,35,36. Nonetheless, distinct outcomes are produced by various environmental regulating tools and disparate firm resource endowments37. As a result, opinions differ regarding how ER affects TI38,39. Pertinent studies can be essentially divided into two perspectives: "follow the cost" and “innovation offset”.

Some scholars contend that ER drives firms to engage in environmental governance40, crowding out firms’ R&D expenditures and inhibiting innovative behavior. According to some academics, ER drives up the amount of money spent on environmental R&D, suppressing expenditures in non-environmental ones and lowering overall levels of innovation41, creating "follow the costs." Using a representative selection of provinces and cities in China, Fang and Shao42 highlight that command-based regulations drive away R&D expenditures and stifle local green innovation. Gao et al.43 point out that while government subsidies stimulate firms’ technological innovation strategies, they also “crowd out” banks’ green bond issuance, thus undermining firms’ technological innovation strategies.

This perspective has been challenged by numerous experts, notably "Porter’s hypothesis", which asserts that sensible ER can foster TI44. Companies can enhance their competitiveness by modernizing industrial processes and optimizing energy efficiency, leading to an “innovation offset” effect that mitigates the adverse effects of "follow the cost." Cainelli et al.45 assert that ER can catalyze green innovation and compel enterprises to enhance waste reduction and material utilization. Researchers propose that ER may foster TI by enhancing optimization46 and enticing “new entrants” into the market39, whereas Manu et al.47 contend that more stringent regulations can catalyze environmental innovation. Some scholars hold the view that government subsidies can enhance private sector corporate social responsibility (CSR)48,49, and a robust sense of CSR will incentivize enterprises to engage in innovation50. Fan & Liang51 also propose that environmental target constraints markedly augment TI, particularly in places characterized by less budgetary pressure and elevated economic development.

Some other academics contend that the relationship between ER and CTI is ambiguous and influenced by variables such as firm size52, affiliation with a significantly polluting industry53,54, and regional and policy disparities55,56. The effect of ER on CTI remains ambiguous due to the conflicting influences of “innovation offset” and "follow the cost." TI can foster economic growth while ensuring environmental governance57,thus, a rise in TI will mitigate environmental degradation51, consequently diminishing the intensity of ER. Prior research has rarely examined the inverse impact of TI on ER. In conclusion, the dynamic relationship of ER on TI requires more examination.

Corporate technological innovation and corporate carbon emissions

The green transition has emerged as a major subject in the discourse on reducing carbon emissions58. Academics have also claimed that accomplishing the Sustainable Development Goals (SDGs) depends on TI59,60,61,62. However, the influence of TI on CO2 emissions is a topic of discussion. Braungardt et al.63 suggest that the “rebound effect” is the reason for the lengthy debate on the impact of innovation on climate goals. At present, the academic community holds the following perspectives.

One perspective posits that TI might mitigate CE, i.e., the "carbon reduction effect." Scholars have indicated that technical advancements can facilitate carbon emission reductions across countries, utilizing samples from EU-27 nations64 and BRICS countries65. Song et al.66 assert that green product innovation not only mitigates resource depletion and enhances utilization efficiency, but also increases product recycling rates and diminishes environmental contamination. Scholars from the digital investment perspective point out that TI is a crucial avenue for enhancing carbon emissions efficiency67. Lin et al.57 analyze panel data from 264 prefectural-level cities in China spanning 2006 to 2017, indicating that post-2010, TI positively influenced urban carbon emission reductions and could indirectly decrease CE through industrial structure improvement. Chen et al.68 also reveal that carbon emissions positively influence urban green technological innovation.

A different perspective highlights the "rebound effect." This effect indicates that TI lowers energy consumption and boosts productivity. However, higher productivity simultaneously increases market demand by lowering the price of commodities, consequently raising CE and energy consumption. According to Yang and Li69, macro-level technical advancement promotes economic expansion, which increases energy consumption. In order to assess the macro carbon renewable energy in 30 provinces of China, Wu et al.70 combine DEA and SML models. Their empirical findings demonstrate that it does have a carbon rebound effect, meaning that technical advancement’s impact on carbon emissions reduction is limited. The existence of “rebound effects” on carbon emissions regarding energy technology innovation71 and digital technology innovation72 has also been confirmed by scholars.

Some other academics contend that there is a nonlinear relationship between TI and CE73,74. Du et al.75 determined, utilizing panel data from 71 economies, that there exists a singular inflection point regarding the influence of green technology innovation on CO2emissions, which may be attributable to the substantial cost investments required for the dissemination of technical advancements. Some scholars believe that there is no significant relationship between TI and CE. Utilizing the IPAT/STIRPAT paradigm, Weina et al.76 illustrate that the extent of green technology had a negligible impact on the performance of 95 Italian regions from 1990 to 2010.

Prior researches have largely overlooked the inverse impact of CE on TI. Only a few academics have noted that SMEs frequently experience funding pressures when improving carbon emission reductions77 and that carbon emission reductions can mitigate financing limitations and facilitate TI78. The relationship between CE and TI remains ambiguous and requires further examination. In conclusion, the literature has not agreed on the relationship between ER, CTI, and CCE, probably due to research methodology, research object, and model selection variations. The previous literature focuses on the unidirectional association between the two of them, omitting any examination of the dynamic interaction among the variables, the endogeneity of the variables, and the lagging issue. Therefore, the current study examines the dynamic interaction among ER, CTI, and CCE with the PVAR model. The following section explores the interactive mechanism between these three variables.

Theoretical foundation of environmental regulation, corporate technological innovation, and corporate carbon emissions

Interaction between environmental regulations and corporate carbon emissions

"Coase’s theorem" underscores the significance of well-defined property rights in resource allocation79. Effective ER can elucidate the property rights associated with emission allowances, and a robust property rights framework can incentivize enterprises to innovate80 and enhance energy utilization efficiency. Furthermore, penalties, energy levies, clean energy incentives, and various regulatory mechanisms might encourage businesses to use clean energy, diminish CE81, and fulfill the objective of "back-forced emission reduction".

The “green paradox” suggests that stricter environmental regulations could lead owners of high-carbon energy resources, anticipating a grim future for their assets, to accelerate the extraction and use of these resources. This would, in turn, increase the overall supply of carbon-intensive energy. Surplus supply diminishes energy prices, stimulating corporate acquisitions and increasing CCE24. Conversely, an escalation in CCE will profoundly affect the environment and society, altering government regulatory actions and creating a "Feedback Regulation Effect".

Interaction between environmental regulation and corporate technological innovation

"Porter’s hypothesis" posits that suitable ER could drive firms to innovate and improve their competitiveness44 , while the "induced innovation theory" indicates that firms will be motivated to develop some new technologies in reaction to increasing resource prices or new regulatory demands. Li et al.82 indicate that well-designed ER can stimulate firms to innovate and reduce the business risks of heavily polluting firms. To be specific, government agencies can elevate the cost of pollution for economic agents by imposing sewage charges, energy taxes, and other obligatory regulatory measures to internalize these costs. Furthermore, the government may implement incentive-based regulatory measures, such as energy subsidies, to internalize the positive externalities generated by innovative behaviors, thereby enhancing the technological innovation of enterprises and creating an “innovation offset”.

According to the "rent-seeking theory," firms may pursue ostensibly “useless” technological breakthroughs to evade government regulation or get subsidies, tax incentives, and other assistance forms, displacing R&D expenditures. Zhang54 indicates that firms with high financing constraints positively engage in “greenwashing” behavior. Conversely, the increase in "follow the costs," namely the escalation of environmental management expenses83, constrains R&D resources and reduces TI. CTI diminishes pollutant emissions, and surpassing regulatory criteria may enable environmental regulators to ease regulatory intensity, resulting in a "technical decoupling effect".

Interaction between corporate technological innovation and carbon emissions

The "ecological modernization theory" posits that by optimizing production processes and fostering TI, environmental problems could be addressed. On the one hand, TI directly mitigates CE by implementing clean energy and low-carbon technology. On the other hand, TI could enhance resource efficiency84, indirectly generating a "carbon reduction effect." Simultaneously, the "diffusion of innovation theory" posits that low-carbon technology can attain a broader scope of carbon emission reductions via market diffusion, including collaborative innovation that facilitates comprehensive emission reductions across the industrial chain.

Nonetheless, the decline in energy prices resulting from technical advancements diminishes production costs85, stimulating greater production and consumption and escalating carbon emissions. The growth of corporate scale resulting from innovations in industrial automation technology would significantly elevate carbon emissions, ultimately causing the "rebound effect." Simultaneously, heightened CE will diminish enterprise competitiveness86, provoke consumer backlash, and invite stringent government regulation, stimulating enterprises to enhance their TI and decrease CE, resulting in the "induced innovation effect," which will undermine third-party government regulatory efforts.

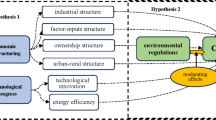

A complex interaction link occurs among ER, CTI, and CCE. Prudent ER can stimulate TI and compel firms to decrease CE, but TI can trigger counterproductive effects while reducing emissions. The three factors must be dynamically balanced in policy development and company operations to attain the mutually advantageous goal of economic progress and environmental preservation.

Based on this, this study points out that ER, CE, and TI interact with each other, and the path of action is shown in Fig. 1.

Methodology

Empirical model

Referring to the study conducted by Ganda87, the PVAR model is built to confirm the interaction and lagged effects among ER, CTI, and CCE. This model integrates the features of panel data and the Vector Autoregressive (VAR) model, enabling it to address both cross-sectional and time series data. Unlike the conventional single-equation model, the PVAR model considers multiple variables as endogenous and examines their dynamic interactions using GMM estimation, Granger causality tests, and impulse response functions, thereby capturing lagged effects and evolutionary patterns among the variables. The model is designed as outlined below:

Here, i = (1,2,3,…,n) denotes different listed firms; t denotes 2005 to 2021; j denotes lag order; yi,t denotes the column vector of endogenous variables; yi,t-j is the jth-order lag term of the endogenous vector; \(\alpha\) 0 is the intercept term; \(\upbeta\) i,j is the matrix to be estimated; and \({\upchi }_{i}+{\lambda }_{t}+{\upvarepsilon }_{i,t}\) are the individual fixed effects, time effects, and random perturbation terms, respectively. In this vein, Eq. (1) could be re-written as follows.

Variables

Data selection and variable construction

The measurement of ER could be categorized into two basic types. The initial measurement pertains to the investment in industrial pollution control in the region where the listed enterprise is located to the industrial added value of that year88. The subsequent measurement involves the ratio of the frequency of environment-related terms within the government work report of the enterprise’s location concerning the total number of words present4,89. Measuring with a single indicator likely results in endogeneity issues given the variety of environmental regulating tools, including pollution control, pollution control practitioners, and policies like clean energy subsidies and carbon trading. Government work reports can serve as a driving force in local work and economic growth since they are local programmatic papers representing the desires and agreements of various social groups. As a result, the endogeneity issue with the traditional measurement indicators can be alleviated by creating local environmental regulation indicators based on the percentage of word frequency linked to “environmental protection” in government work reports at all levels of total word frequency. This will reflect the regulation level of each location more thoroughly and objectively.

This investigation consequently uses the second method as the measurement standard. To assess the degree of ER in each city from 2005 to 2021, we referred to the studies of Chen and Chen90 and Lin et al.91, choosing 27 words, such as "environmental protection," "environmental protection," "green water," "green mountains," "ecology," "pollution," etc., as the measurement of it. We created a Word set using R software to perform a textual analysis of work reports from the local government from 2005 to 2021. The original reports are from official government websites. All the selected terms are shown in Fig. 2.

We take into account the lengthy patent award period and the fact that applying for a patent might already help businesses reduce their carbon footprint. As a result, this study employs the number of patent applications filed by publicly traded companies to assess the level of CTI. The patent data is sourced from the China National Intellectual Property Administration.

According to Doda et al.92 and Haque et al.93, the majority of mainstream measurements of corporate carbon emissions are based on ESG or CSR report disclosures and use the total of Scope I: Direct Emission and Scope II: Indirect Electricity Emission for measurement. Unfortunately, data availability is unsatisfactory, and there is an absence of voluntary carbon disclosures by Chinese-listed corporations. As a result, the following formula is used by this study to estimate company carbon emissions based on industrial carbon emissions, using Chen’s94 measurement:

In the above equation, the business cost of enterprises comes from the CSMAR database. The CE of industries are from the China Carbon Emission Accounting Database. The business cost of industries is from the China Industrial Yearbook. The variables, code, and construction method are shown in Table 1.

Data processing

The following criteria are used to clean the data as mentioned above: (1) remove Special Treatment (ST) and Particular Transfer (PT) firms; (2) remove firms with missing samples; and (3) remove financial industry enterprises. Ultimately, the panel data from 2005 to 2021 comprise 27,170observations from 3243 firms. The data are logarithmically treated in this work using R and Stata15 for data processing and empirical tests in order to minimize heteroscedasticity.

Characteristic statistics

The descriptive statistics for each variable are shown in Table 2. It demonstrates significant variations amongst the listed companies in China, with a mean carbon emissions value of 2.809. The TI value of firms ranges from 0 to 9.394, signifying a discrepancy in the cultivated capacity for innovation among the firms. Additionally, each city’s average degree of ER is -5.789, suggesting that each reacts favorably to promoting the dual-carbon strategy.

Empirical analysis

Before commencing the PVAR analysis, the subsequent procedures must be executed. In order to avoid false regression, it is vital to do a unit root test on the data to verify its smoothness, regardless of whether the non-smooth series requires single involution or counteraction. Subsequently, we ascertain the model’s ideal latency order to guarantee the parameter estimation’s precision. Stability testing and regression analysis then follow. Impulsive response analysis is employed to assess the dynamic influence of ER on CCE. Additionally, variance decomposition is utilized to compare the cumulative contributions of different variables.

Test of unit root

PVAR necessitates that the variables be in a smooth series to prevent the emergence of pseudo-regression; if they are not, differentiation must be done until they attain smoothness. Standard unit root examinations consist of the HT test, the LLC test, and the Fisher test. In our study, balanced processing substantially reduces the sample size by approximately 70%, so we do not employ this approach. Since the LLC test and HT test only support the balanced panel, we chose the ADF-Fisher test to determine the test’s smoothness. The outcomes appear in Table 3. The unit root test generates results that reject the initial hypothesis that "the series is not smooth" at a 1% significance level for all variables. This indicates that the data are smooth and can be further analyzed using the PVAR model for regression analysis.

Determination of lag order

The current study aims to ascertain the lag order of the PVAR model using the Consistent Moment and Model Selection Criteria (CMMSC) proposed by Andrews and Lu95. The Hannan-Quinn Information Criterion (HQIC), Akaike Information Criterion (AIC), and Bayesian Information Criterion (BIC) are computed for each order in the model and compared to the minimal value, the lag order corresponding to this value is optimal. Based on the outcomes of the Table 4 test, it is evident that the optimal lag order for AIC is 4th order, whereas for BIC and HQIC is 2nd order. Consequently, the lag order of the PVAR model is established as the 2nd order as determined by this investigation.

GMM regression estimation

Based on the above optimal second order, GMM is estimated for the sample listed firms to analyze the variables’ long- and short-term interactions. Table 5 shows the specific parameters of GMM.

According to the estimation outcomes in Table 5, we observe that when ER functions as the explanatory variable, ER in both periods positively correlates with the intensity of current period at the 1% level with coefficients of 0.660 and 0.291, respectively. Furthermore, the absolute value of lagged one-period is significantly greater than that of two-period, suggesting that ER is self-accumulating itself, but this cumulative effect declines over time. ER in the current period is inhibited by CTI during the two periods at the 1% significance level with coefficients of –0.065 and –0.029, respectively. This implies that the Government’s regulatory intensity diminishes as enterprises advance in technological sophistication. Furthermore, the significance test fails to apply to the impacts of lagged one-period and lagged two-period CCE on ER.

The explanatory variable in this case is CTI. The current period is significantly influenced by the two periods of ER, as indicated by the significant coefficients of 1.034 and 0.716, both at the 1% level. This suggests ER may compel businesses to enhance their technological innovation capacity to satisfy market demands and environmental governance expectations; however, this facilitating effect diminishes over time. The CTI during the two time periods positively influences the innovation level of businesses during the current period. This conclusion is supported by a 1% significance test, which suggests that CTI has a self-promoting effect. The CTI is substantially hampered in the current period by CCE in the two periods with coefficients of -0.505 and -0.089, respectively, both significant at the 1% level. This suggests that the rise in CCE could result in increased expenses for environmental governance, which could impede R&D expenditures and inhibit TI.

In the case of CCEc as the explanatory variable, the current period’s level is influenced by the lagged one- and two- periods. The coefficients for these effects are –0.024 and 0.629, respectively, and statistically significant at the 5% level. These results indicate that CCE may exhibit a self-accumulating effect. At a 1% significance level, ER in both periods increases CCE in the current period. This suggests that ER is not achieving the intended short-term reduction of carbon emissions. The rebound effect may account for this. At the 1% significance level, CTI suppresses carbon emissions during both periods (coefficients of –0.105 and –0.052, respectively), indicating that better technological innovation can reduce emissions.

Unit circle test

The unit circle test evaluates the stability of PVAR through the computation of the model’s unit root eigenvalues. The test determines whether the model passes stability if all eigenvalues lie within the circle (with a value below 1). The PVAR model developed in this study passes the stability test, as evidenced by all six estimation points within the unit circle (see Fig. 3). This signifies that the model creates a lasting and stable correlation among the variables over a prolonged duration.

Granger causality test

The Granger causality test is now implemented to examine the causal connection among the diverse economic variables. The original hypothesis is rejected when the P-value is below 0.1, suggesting a causal relationship between the variables. The P-values of all the tests, as presented in Table 6, reject the original hypothesis. This suggests a bidirectional Granger causality between ER and CTI, as well as between CTI and CCE, along with a unidirectional causality between ER and CCE. It indicates that all variables can be predicted from one another, except for the historical values of CCE, which cannot be used to predict ER. Impulse response analysis and GMM estimation of the variables are necessary to elucidate the immediate and prolonged correlation among the three.

Impulse response analysis

Because PVAR is a dynamic model and the aforementioned GMM estimation results represent a static interaction between ER, CTI, and CCE, impulse response analysis is required to validate the dynamic correlation among the three variables. While holding all other variables constant, the impulse response can simulate the dynamic effect of a standardized stimulus on one variable upon another variable in subsequent periods. In light of this study’s lengthy panel data time series, the shock duration is established at 20 periods. To simulate the impulsive response outcomes between the three periods, 500 Monte Carlo simulations are utilized. The periods are represented on the horizontal axis, responsiveness is depicted on the vertical axis, and the 95% confidence intervals are delineated on the upper and lower curves, as illustrated in Fig. 4.

-

1)

From 1a, 2a, and 3a of Fig. 3, the positive response to a one-standard-deviation shock to ER is rapid and attains its peak value in the current period. Subsequently, the value fluctuates and declines until it approaches zero in the sixth period, at which point it transforms into a weak negative impact by the eighth period. This indicates that ER has a positive superposition effect, and enterprises are influenced by the increasing intensity of regulation each year. The response value of CTI remains above zero throughout all periods when ER has an impact of one standard deviation. The maximum value is observed in the second period, exhibiting an overall inverted U-shape pattern. The response value converges to zero by the tenth period, suggesting that ER has a more pronounced and enduring impact on the innovation capability of the enterprise. When confronted with a standard deviation shock caused by ER, CCE exhibits an inverted U-shape trend: initially increasing and subsequently decreasing. The seventh period of this pattern consists of a decline below the 0 axis, followed by a convergence to 0 in the distant future. This could be attributed to the Government’s implementation of environment-related regulations aimed at raising the expenses associated with business environmental management. As a result, businesses are compelled to upgrade their technology, conserve energy, reduce emissions, transition to cleaner energy sources, and decrease their consumption of high-carbon energy sources. Hence, carbon emissions of corporations emit diminish. Nevertheless, heightened extraction has ensued in the short term due to supply-side anticipations of forthcoming energy policy contractions. This, in turn, expands the accessibility of high-carbon energy sources, culminating in reduced prices. Ultimately, it prompts corporations to augment their procurement and utilization of such sources, giving rise to the green paradox. In the long term, however, enhancing the competitiveness of businesses through technical advancement, industrial upgrading, and other means to reduce CCE is consistent with the objective of SDGs; thus, ER can ultimately impede CCE. Put differently, implementing ecological regulations to reduce CCE experiences a temporal delay.

-

2)

According to 1b, 2b, and 3b of Fig. 3, the response value of CTI to a standard deviation shock to itself reaches its maximum in the current period, but it declines quickly and eventually falls below the 0-axis after three periods. It tends to be close to 0 in the distant future, exhibiting a smooth characteristic. The results demonstrate that CTI has a specific self-reinforcing effect, but that effect is only temporary. It will exert some downward pressure on itself in the future, but this downward force will be minimal, which means corporations should hasten innovation potential. ER is less than 0 when one standard deviation of CTI is applied, except for the current period. It peaks in the third period and eventually approaches zero, with a U-shape overall pattern demonstrating that CTI sends positive signals and lowers government regulations. When CCE is subject to the standard deviation impact of CTI, the response value reaches its maximum value in the current period. After that, it exhibits an initial downward trend followed by an upward trend, peaking at a high value in the third period and eventually approaching zero in the tenth. The trend indicates in the short term that the enterprise will increase its carbon emissions due to higher production and other factors brought about by technological innovation; however, in the long run, it will reduce CCE thanks to decreases in energy consumption, an increase in the rate at which energy is utilized, etc. Consequently, even while CTI has a lag impact when promoting a decrease in carbon emissions, it ultimately optimizes the level of CCE.

-

3)

As demonstrated by 2c and 3c of Fig. 3, CTI does not respond to a one standard deviation increase in CCE in the present period, declines quickly after the first period, reaches an extreme value in the second period, and tends to zero in the long run. This suggests that CCE does not affect CTI; however, over time, rising environmental management costs due to increasing carbon emissions may stifle innovation levels and reduce R&D expenditures, which causes a drop in the degree of technological innovation. Alternatively, the Government regulates high levels of carbon emissions, sending negative signals to the market and creating financial challenges that lower CTI. A long-run self-accumulation impact of CCE is indicated by the fast positive reaction to a standard deviation shock in CCE, reaching its highest value in the present period and rapidly decreasing to zero in the fourth period. Due to the failure of the Granger test, the analysis does not include the examination of 1c, which pertains to the effect of CCE on ER.

A few predictions can be made based on the impulse response and the GMM estimation results. First, there are self-reinforcing mechanisms linking ER and CCE, but they will weaken over time. Additionally, CTI has a superimposed effect. Second, the impact of ER on CCE takes time to manifest. Moreover, the benefits of reducing carbon emissions must be sustained for a given time. While CTI influences ER, CCE does not directly affect ER. Third, CTI has an inhibitory effect on ER. Over time, ER will raise the degree of CT. Fourth, CTI spurs higher CCE in the short term but diminishes them over time. CCE continues to impede CTI.

Variance decomposition

Variance decomposition allows for quantifying the effects of various disturbance factors on the variability of endogenous variables. This approach enables a more precise assessment of the long-term interplay among ER, CTI, and CCE. Table 7 displays the outcomes of variance decomposition analysis, while the dataset used for analysis has 20 periods. As a result of spatial constraints, Table 7 exclusively presents a subset of the variance decomposition outcomes.

1) Two key factors primarily influence ER. First, it is influenced by itself. The initial era witnessed a significant ER change, with a 94.3% deviation from the baseline. However, this deviation gradually reduces over subsequent periods, stabilizing at 85.7% in the long term. Furthermore, it is impacted by self-driven technical advancements. The aforementioned influence manifests during the subsequent period and gradually increases, reaching a value of 10.9% in each subsequent period. Moreover, the fluctuating impact of CCE on ER is observed to be at a rate of 3% throughout 20 periods. This relatively modest contribution reinforces the conclusion of no Granger causality between CCE and ER.

2) CTI is shaped by three key variables. The proportion of technological innovation’s contribution to itself experiences a decline from 84.2% in the initial period to 41.7% in the 10th period and remains stable over the long term. The long-term impact of ER on CTI also plays a role, starting at 5.4% in the 1st period and increasing to 48.9% in the 9th period before stabilizing. ER significantly influences the long-term effects of CTI. The influence of CCE on CTI exhibits a rather persistent nature, as observed throughout many periods. Specifically, the fraction of this impact fluctuates around 10% from the initial period to the 10th period, eventually settling at 9.4% in the long run.

3) CCE is impacted by three distinct levels. One of them is mainly influenced by itself. During the initial period, the influence on itself constitutes 100% of the overall impact. However, starting with the second period, the influences of ER and CTI progressively emerge and indicate a gradually increasing trajectory. The stability of carbon emissions’ contribution to itself is approximately 67%, whereas the contributions of ER and CTI exhibit fluctuations around 11.2% and 21.8%, respectively. A comparative analysis over different periods reveals that their persistence mostly drives CCE. Furthermore, the CCE is also influenced by ER and technical advancements, with the latter having an enormous impact.

The outcomes of the 15th and 20th forecast intervals exhibit a high degree of similarity, suggesting that following 15 forecast intervals, the impact of each variable’s shock on itself or the other two variables remains relatively constant. Over time, a sustained and reciprocal relationship exists among ER, CTI, and CCE.

Robustness test

To enhance the reliability of the estimation outcomes, this study uses the methodology of variable substitution. Given the comprehensiveness and accessibility of the data, the metric for assessing CTI is substituted by the count of filed patents of invention (PI) or patents of green innovation (GTI). The lag period that yields the best results remains at two periods. The outcomes of the unit root test exhibit stability, and the estimation results obtained by the GMM largely align with the symbol above. Furthermore, the observed variations in coefficients are minimal. The plots of the impulse response function and the variance decomposition findings demonstrate considerable similarity. Table 8 presents the results of the GMM regression exclusively. The empirical results discussed above are robust in this work.

Conclusions

The following conclusions are drawn from constructing a PVAR model to verify the long-term interaction of ER, CTI, and CCE using panel data of Shenzhen and Shanghai-listed companies in China from 2005 to 2021 as a sample.

First, the findings of the GMM and Granger causality test indicate a direct or indirect causal relationship among the three factors above. CCE and CTI have a bidirectional impact, with CCE having a more substantial impact on CTI. There is also a bidirectional causal relationship between ER and CTI, and the former has a more noticeable effect on the latter. ER has a direct impact on CCE. Besides, CCE has an indirect impact on ER through CTI. Figure 4 below illustrates the relationships among them.

Second, the impulse response function and GMM estimation findings demonstrate self-reinforcing mechanisms for ER, CTI, and CCE. In the short term, the green paradox raises emissions. Still, in the long term, ER lowers the amount of high-carbon energy businesses use and raises energy utilization efficiency, which can have a long-lasting inhibitory effect. CTI reduces the strength of ER, and ER drives CTI, and this impact lessens over time. CTI is a long-term driver of enterprise carbon emission reductions and can have the most potent inhibitory effect during lag periods. This suggests that increasing CTI levels can aid in achieving enterprise carbon emission reductions, but CCE impedes these efforts. Possible causes include rising carbon emissions, greater environmental governance costs, negative signals released to the market, and other factors affecting enterprise financing. These factors may contribute to insufficient enterprise R&D investment, lowering CTI.

Third, while CCE does not Granger cause ER, the variance decomposition results indicate that ER has the most significant impact on itself, followed by CTI. Moreover, CTI has a higher influence on CCE than ER, with the largest contribution coming from self-contribution. To lower the carbon emissions of corporations, the Government needs to focus on creating favorable conditions for firms, in addition to relying on reasonable environmental regulation policies.

Policy recommendations and future directions

Policy recommendations

Drawing from the conclusions above, this study offers some specific recommendations.

First, the government should create favorable conditions to encourage CTI by increasing support, advocating firms’ R&D initiatives, and enhancing the long-term impact of carbon emission reductions. Since R&D activities have long cycles and are vulnerable to financial constraints, government subsidies, tax incentives, and green technology funds can provide companies with a conducive innovation environment. Financial support ensures economic stability and signals positively to the market, attracting social capital and fostering a virtuous cycle. However, enterprise R&D generates significant positive externalities, making it difficult for companies to fully capitalize on its benefits. Therefore, the government must strengthen intellectual property protection by optimizing the patent application process, reducing acquisition time, and safeguarding corporate IP rights. Additionally, advancing digitization and decentralization can help firms internalize CTI benefits. Lastly, enhancing transparency in corporate data related to CCE and CTI will improve public and investor understanding of environmental performance, promote corporate social responsibility, and support carbon reduction efforts.

Second, firms should enhance their awareness of TI and increase R&D investments by integrating TI into their core objectives and prioritizing sustained research in low-carbon and green technologies to ensure tangible carbon emission reductions. With government financial support and policy incentives, companies can expand R&D efforts, recruit skilled professionals, and accelerate technological transformation to build new competitive advantages. Collaborating with universities, research institutes, and scientific organizations can further drive environmental technology development through resource sharing and joint research, fostering a shift from "passive emission reduction" to "proactive emission reduction." Additionally, firms must adapt their energy consumption strategies in response to regulatory changes, invest in renewable energy and clean technologies, reduce carbon emissions, and enhance their environmental reputation.

Third, the government should overhaul the energy structure further, and businesses should embrace sustainable energy production. Coal accounts for the majority of China’s energy consumption; therefore, fossil fuel use should be decreased, renewable energy development should be encouraged, and coal production capacity structure should be maximized. Encourage market-oriented change in the energy sector, enhance the pricing system, and assist businesses in using less expensive energy. From the perspective of firms, energy-listed firms may increase the clean and efficient use of coal and lessen the burden on carbon emissions by enhancing carbon capture and utilization by upgrading intelligent mining technology. Manufacturing, chemical, iron and steel, and other energy-consuming listed companies should increase green energy procurement, such as through participation in green power trading, the layout of distributed photovoltaic power generation, self-built energy storage facilities, etc., to reduce traditional energy consumption and increase the proportion of renewable energy use, in order to adapt to the "dual-carbon" policy and the needs of market competition.

Fourth, the government should sensibly apply environmental laws, using a balanced approach that includes restrictions and incentives. Relying solely on emission allowances, environmental standards, and other control-based regulations is unlikely to effectively drive corporate carbon emission reductions. This approach can increase the cost of environmental management, limit R&D investment, and undermine CTI capacity. Emissions trading, environmental subsidies, and other incentive-based methods should be utilized to achieve regulatory goals. Furthermore, technological innovation must be encouraged. The government can also reduce the “green paradox” risk by carefully managing environmental regulations, including rationalizing the timing and methods of carbon tax collection and shortening the cycle for implementing new environmental policies. Lastly, because the impact of environmental regulation on corporate carbon emissions takes time, authorities should focus on long-term effects and their cumulative impact when developing policies.

The link between the economy and the environment must be balanced to be achieved properly. Environmental deterioration cannot occur at the price of economic progress. To create a positive interaction among ER, CTI, and CEE and focus on the sustainable development of businesses and human society, the steps mentioned above should be taken to fully realize the synergistic effect of ER and CTI.

Limitations and future directions

It should be pointed out that this study does not take firms’ heterogeneity into account because of limited data availability and resource endowment diversification. Additionally, this paper concentrates on the strength of environmental regulations without considering how particular environmental policies affect CCE and CTI. Thus, subsequent research may concentrate on the following two areas.

The first area is the influence of company heterogeneity of governance structure on ER and technological innovation’s ability to reduce carbon emissions. For example, in the case of state-owned enterprises, there is a large gap between them and private enterprises regarding their establishment purpose, resource endowment, etc. Thus, there may be a large difference in their sensitivity to and implementation of regulatory policies compared to private enterprises.

Then, studies can target how various environmental policies affect business interactions and conflicts. Future research can concentrate on how to best leverage the synergy between policies and internal governance structures of businesses. Energy policies, climate uncertainty, and even enterprise governance all impact carbon emissions in addition to environmental regulatory policies.

Data availability

Availability of data and materials: All relevant datasets used and/or analysed during the current study are within the paper.

References

Muccione, V. et al. Adaptation pathways for effective responses to climate change risks. Wiley Interdiscip. Rev.-climate ch. https://doi.org/10.1002/wcc.883 (2024).

Xin, D. et al. Do innovation in environmental-related technologies asymmetrically affect carbon dioxide emissions in the United States?. Technol. Soc. 67, 101761. https://doi.org/10.1016/j.techsoc.2021.101761 (2021).

Dong, J. et al. Can corporate digital innovation speed up climate change mitigation? Evidence From China. IEEE Trans. Eng. Manage. 71, 7797–7814. https://doi.org/10.1109/TEM.2024.3386181 (2024).

Chang, K. W. et al. The impact of green technology innovation on carbon dioxide emissions: The role of local environmental regulations. J. Environ. Manage. https://doi.org/10.1016/j.jenvman.2023.117990 (2023).

Peng, H., Shen, N., Liao, H., Xue, H. & Wang, Q. Uncertainty factors, methods, and solutions of closed-loop supply chain — A review for current situation and future prospects. J. Clean. Prod. 254, 120032. https://doi.org/10.1016/j.jclepro.2020.120032 (2020).

Tanthanongsakkun, S., Treepongkaruna, S. & Jiraporn, P. Carbon emissions, corporate governance, and staggered boards. Bus. Strat. Environ. 32(1), 769–780. https://doi.org/10.1002/bse.3174 (2022).

Perdichizzi, S., Buchetti, B., Cicchiello, A. F. & Dal Maso, L. Carbon emission and firms’ value: Evidence from Europe. Energy Econ. 131, 107324. https://doi.org/10.1016/j.eneco.2024.107324 (2024).

Gonenc, H. & Krasnikova, A. V. Board gender diversity and voluntary carbon emission disclosure. Sustainability https://doi.org/10.3390/su142114418 (2022).

Chen, S., Mao, H. & Sun, J. Low-carbon city construction and corporate carbon reduction performance: Evidence from a quasi-natural experiment in China. J. Bus. Eth. 2021, 1–19. https://doi.org/10.1007/s10551-021-04886-1 (2021).

Chen, P. Y. Corporate social responsibility, financing constraints, and corporate carbon intensity: New evidence from listed Chinese companies. Environ. Sci. Pollut. Res. Int. https://doi.org/10.1007/s11356-023-25176-5 (2023).

Vecchiato, R., Do, H., Pierrakis, Y. & Blackburn, R. Innovation and foresight in SMEs: Lessons from the case of UK digital health companies. IEEE Trans. Eng. Manage. 71, 1655–1668. https://doi.org/10.1109/TEM.2023.3336732 (2024).

Dwivedi, Y. K. et al. Climate change and COP26: Are digital technologies and information management part of the problem or the solution? An editorial reflection and call to action. Int. J. Inf. Manage. 63, 102456. https://doi.org/10.1016/j.ijinfomgt.2021.102456 (2022).

Li, Z., Huang, Z. & Su, Y. New media environment, environmental regulation and corporate green technology innovation: Evidence from China. Energy Econ. 119, 106545. https://doi.org/10.1016/j.eneco.2023.106545 (2023).

Sun, Y. Chinas target responsibility system and convergence of CO2 emissions. Singapore Econ. Rev. 63(2), 431–445 (2018).

Hu, S. et al. Voluntary environmental regulations, greenwashing and green innovation: Empirical study of China’s ISO14001 certification. Environ. Impact Assess. Rev. 102, 107224. https://doi.org/10.1016/j.eiar.2023.107224 (2023).

Chen, Y., Jiang, S., Lim, K. Y. & Morris, D. Corporate “Greening” and innovation: A reinterpretation based on historical immortals. Bus. Strategy. Environ. https://doi.org/10.1002/bse.4105 (2024).

Ahmad, M., Ahmed, Z., Riaz, M. & Yang, X. Modeling the linkage between climate-tech, energy transition, and CO2 emissions: Do environmental regulations matter?. Gondwana Res. 127, 131–143. https://doi.org/10.1016/j.gr.2023.04.003 (2024).

Wolde-Rufael, Y. & Mulat-Weldemeskel, E. Effectiveness of environmental taxes and environmental stringent policies on CO2 emissions: The European experience. Environ. Dev. Sustain. 25(6), 5211–5239. https://doi.org/10.1007/s10668-022-02262-1 (2022).

Kou, P., Han, Y., Jin, B. & Li, T. How informal environmental regulations constrain carbon dioxide emissions under pollution control and carbon reduction: Evidence from China. Environ. Res. 252, 118732. https://doi.org/10.1016/j.envres.2024.118732 (2024).

Gu, G. et al. Does carbon financial market as an environmental regulation policy tool promote regional energy conservation and emission reduction? Empirical evidence from China. Energy Policy 163, 112826. https://doi.org/10.1016/j.enpol.2022.112826 (2022).

Xiao, B. et al. The impacts of environmental tax in China: A dynamic recursive multi-sector CGE model. Energies 8(8), 7777–7804. https://doi.org/10.3390/en8087777 (2015).

Liao, N., Luo, X. & He, Y. Could environmental regulation effectively boost the synergy level of carbon emission reduction and air pollutants control? Evidence from industrial sector in China. Atmospheric Pollut. Res. 15(8), 102173. https://doi.org/10.1016/j.apr.2024.102173 (2024).

Khan, Z. et al. Environmental regulations an option: Asymmetry effect of environmental regulations on carbon emissions using non-linear ARDL. Energy Sour. Part a-Recover. Utilization Environ. Eff. 41(2), 137–155. https://doi.org/10.1080/15567036.2018.1504145 (2019).

Sinn, H. W. Public policies against global warming: A supply side approach. Int. Tax Public Finance 15, 360–394. https://doi.org/10.1007/s10797-008-9082-z (2008).

Smulders, S., Tsur, Y. & Zemel, A. Announcing climate policy: Can a green paradox arise without scarcity?. J. Environ. Econ. Manage. 64(9), 364–376. https://doi.org/10.2139/ssrn.1742789 (2012).

Van Der Ploeg, F. & Withagen, C. Is there really a green paradox?. J. Environ. Econ. Manage. 64(3), 342–363. https://doi.org/10.2139/ssrn.1562463 (2012).

WangWel, H. W. Coordinating technological progress and environmental regulation in CO2 mitigation: Theoptimal levels for OECD countries&emerging economies. Energy Econ. 87, 104510. https://doi.org/10.1016/j.eneco.2019.104510 (2019).

Baloch, M. A. & Danish, F. N. M. CO2 emissions in BRICS countries: What role can environmental regulation and financial development play?. Clim. Ch. https://doi.org/10.1007/s10584-022-03362-7 (2022).

Cao, Y., Ren, W. & Yue, L. Environmental regulation and carbon emissions: New mechanisms in game theory. Cities 149, 104945. https://doi.org/10.1016/j.cities.2024.104945 (2024).

Guo, W. & Chen, Y. Assessing the efficiency of China’s environmental regulation on carbon emissions based on Tapio decoupling models and GMM models. Energy Rep. 4, 713–723. https://doi.org/10.1016/j.egyr.2018.10.007 (2018).

Xu, B. Environmental regulations, technological innovation, and low carbon transformation: A case of the logistics industry in China. J. Clean. Prod. 439, 140710. https://doi.org/10.1016/j.jclepro.2024.140710 (2024).

Aydin, C. & Esen, Ö. Reducing CO2 emissions in the EU member states: Do environmental taxes work?. J. Environ. Plann. Manage. 61, 2396–2420. https://doi.org/10.1080/09640568.2017.1395731 (2018).

Rennings, K. Redefining innovation—eco-innovation research and the contribution from ecological economics. Ecol. Econ. 32(2), 319–332. https://doi.org/10.1016/S0921-8009(99)00112-3 (2000).

Behera, P. & Sethi, N. Nexus between environment regulation, FDI, and green technology innovation in OECD countries. Environ. Sci. Pollut. Res. 29(35), 52940–52953. https://doi.org/10.1007/s11356-022-19458-7 (2022).

Pan, X. et al. The cleaner production technology innovation effect of environmental regulation policy: Evidence from China. Manage. Environ. Qual. Int. J. https://doi.org/10.1108/MEQ-10-2020-0227 (2021).

Ye, Z., Li, C. H. & Yao, L. Impact of environmental regulations on the innovation of SMEs: Evidence from China. Environ. Technol. Innov. https://doi.org/10.1016/j.eti.2021.101515 (2021).

Wang, Z., Xia, C. & Xia, Y. Dynamic relationship between environmental regulation and energy consumption structure in China under spatiotemporal heterogeneity. Sci. Total Environ. 738, 140364. https://doi.org/10.1016/j.scitotenv.2020.140364 (2020).

Martínez-Zarzoso, I., Bengochea-Morancho, A. & Morales-Lage, R. Does environmental policy stringency foster innovation and productivity in OECD countries?. Energy Policy 134, 110982. https://doi.org/10.1016/j.enpol.2019.110982 (2019).

Yan, Z., Yu, Y., Du, K. & Zhang, N. How does environmental regulation promote green technology innovation? Evidence from China’s total emission control policy. Ecol. Econ. 219, 108137. https://doi.org/10.1016/j.ecolecon.2024.108137 (2024).

Leeuwen, G. V. & Mohnen, P. Revisiting the Porter hypothesis: An empirical analysis of Green innovation for the Netherlands. Economics of Innovation and New Technology. 26(1 2), 63. https://doi.org/10.1080/10438599.2016.1202521 (2017).

Kneller, R. & Manderson, E. Environmental regulations and innovation activity in UK manufacturing industries. Resour. Energy Econ. 34(2), 211–235. https://doi.org/10.1016/j.reseneeco.2011.12.001 (2012).

Fang, Y. & Shao, Z. Whether green finance can effectively moderate the green technology innovation effect of heterogeneous environmental regulation. Int. J. Environ. Res. Public Health 19(6), 3646. https://doi.org/10.3390/ijerph19063646 (2022).

Gao, Y., Ning, J. & Zhang, M. An evolutionary game dynamic analysis of enterprise technological innovation implementation strategy: From the perspective of green bonds. IEEE Trans. Eng. Manage. 71, 11551–11564. https://doi.org/10.1109/TEM.2024.3425951 (2024).

Porter, M. E. & van der Linde, C. Toward a new conception of the environment— Competitiveness relationship. J. Econ. Perspect. 9(4), 97–118 (1995).

Cainelli, G., D’Amato, A. & Mazzanti, M. Resource efficient eco-innovations for a circular economy: Evidence from EU firms. Res. Policy. 49(1), 10382 (2019).

Nazir, R., Gillani, S. & Shafiq, M. N. Realizing direct and indirect impact of environmental regulations on pollution: A path analysis approach to explore the mediating role of green innovation in G7 economies. Environ. Sci. Pollut. Res. Int. https://doi.org/10.1007/s11356-023-25399-6 (2023).

Manu, E. K., Chen, G. S. & Adomako, S. Do environmental regulations and technological innovation enhance environmental well-being in sub-Saharan Africa?. Bus. Strat. Environ. 33(6), 5736–5752. https://doi.org/10.1002/bse.3772 (2024).

Khurshid, A., Cifuentes-Faura, J., Ying, H. & Saleem, S. F. Corporate social responsibility in the era of government subsidies: A novel empirical perspective on market competitiveness. Corp. Soc. Responsib. Environ. Manage. 32(1), 102–117. https://doi.org/10.1002/csr.2938 (2025).

Wenqi, D., Khurshid, A., Rauf, A. & Calin, A. C. Government subsidies’ influence on corporate social responsibility of private firms in a competitive environment. J. Innov. Knowl. 7(2), 100189. https://doi.org/10.1016/j.jik.2022.100189 (2022).

Khurshid, A., Hongbin, Y., Cifuentes-Faura, J. & Saleem, S. F. Does corporate social responsibility and environmental governance drive green innovation?. Corp. Soc. Responsib. Environ. Manage. 32(1), 58–70. https://doi.org/10.1002/csr.2942 (2025).

Fan, H. & Liang, C. Effective government and regional technological innovation: Evidence from 284 Cities in China. Regul. Gov. https://doi.org/10.1111/rego.12649 (2024).

Borsatto, J. M. L. S. & Amui, L. B. L. Green innovation: Unfolding the relation with environmental regulations and competitiveness. Resour. Conserv. Recycl. 149, 445–454. https://doi.org/10.1016/j.resconrec.2019.06.005 (2019).

Ren, X., Li, Y., Shahbaz, M., Dong, K. & Lu, Z. Climate risk and corporate environmental performance: Empirical evidence from China. Sustain. Prod. Consum. 30, 467–477. https://doi.org/10.1016/j.spc.2021.12.023 (2022).

Zhang, D. Environmental regulation, green innovation, and export product quality: What is the role of greenwashing?. Int. Rev. Fin. Anal. 83, 102311. https://doi.org/10.1016/j.irfa.2022.102311 (2022).

Bothongo, K. & Kinyar, A. Factors associated with the adoption of eco-innovation and its effect on environmental performance in the US household cleaning sector. Technol. Forecast. Soc. Chang. 210, 123898. https://doi.org/10.1016/j.techfore.2024.123898 (2025).

Guo, B., Feng, Y. & Wang, X. The effect of environmental information disclosure on carbon emission. Pol. J. Environ. Stud. 33(2), 1681–1691. https://doi.org/10.15244/pjoes/173106 (2024).

Lin, B. Q. & Mar, Y. Green technology innovations, urban innovation environment and CO2 emission reduction in China:fresh evidence from a partially linear functional-coefficient panel model. Technol. Forecast. Soc. Ch. 176, 121434. https://doi.org/10.1016/j.techfore.2021.121434 (2022).

Wu, F., Hu, Y. & Shen, M. The color of FinTech: FinTech and corporate green transformation in China. Int. Rev. Fin. Anal. 94, 103254. https://doi.org/10.1016/j.irfa.2024.103254 (2024).

Ahmad, N., Nguyen, D. K. & Tian, X.-L. Assessing the impact of the sharing economy and technological innovation on sustainable development: An empirical investigation of the United Kingdom. Technol. Forecast. Soc. Ch. 209, 123743. https://doi.org/10.1016/j.techfore.2024.123743 (2024).

Feng, L., Chen, H., Bilan, Y., Khan, S. & Zhan, W. Green innovation: The role of government subsidies under the system of digital finance -based on a zero-inflated negative binomial model. Environ. Dev. Sustain. 26(11), 29621–29642. https://doi.org/10.1007/s10668-024-04856-3 (2024).

Sinha, A., Sengupta, T. & Alvarado, R. Interplay between technological innovation and environmental quality: Formulating the SDG policies for next 11 economies. J. Clean. Prod. 242, 118549. https://doi.org/10.1016/j.jclepro.2019.118549 (2019).

Yin, Z. H. & Zeng, W. P. Path to sustainable development: Can industrial intelligence and technological innovation balance economic growth and environmental quality in China?. Sustain. Dev. 32(5), 4486–4504. https://doi.org/10.1002/sd.2918 (2024).

Braungardt, S., Elsland, R. & Eichhammer, W. The environmental impact of eco-innovations: The case of EU residential electricity use. Environ. Econ. Policy Stud. 18(2), 213–228. https://doi.org/10.1007/s10018-015-0129-y (2016).

TöbelmannWendler, D. T. The impact of environmental innovation on carbon dioxide emissions. J. Clean. Prod. 244, 118787. https://doi.org/10.1016/j.jclepro.2019.118787 (2020).

Andrew, A. A., Adebayo, T. S., Lasisi, T. T. & Muoneke, O. B. Moderating roles of technological innovation and economic complexity in financial development-environmental quality nexus of the BRICS economies. Technol. Soc. 78, 102581. https://doi.org/10.1016/j.techsoc.2024.102581 (2024).

Song, M., Wang, S. & Zhang, H. Could environmental regulation and R&D tax incentives affect green product innovation?. J. Clean. Prod. 258, 120849. https://doi.org/10.1016/j.jclepro.2020.120849 (2020).

Xu, Q., Zhong, M. & Cao, M. Does digital investment affect carbon efficiency? Spatial effect and mechanism discussion. Sci. Total Environ. 827, 154321. https://doi.org/10.1016/j.scitotenv.2022.154321 (2022).

Chen, Y., Yao, Z. & Zhong, K. Do environmental regulations of carbon emissions and air pollution foster green technology innovation: Evidence from China’s prefecture-level cities. J. Clean. Prod. 350, 131537. https://doi.org/10.1016/j.jclepro.2022.131537 (2022).

Yang, L. & Li, Z. Technology advance and the carbon dioxide emission in China – Empirical research based on the rebound effect. Energy Policy 101, 150–161. https://doi.org/10.1016/j.enpol.2016.11.020 (2017).

Wu, L. et al. Estimation of China’s macro-carbon rebound effect: Method of integrating data envelopment analysis production model and sequential malmquist-luenberger index. J. Clean. Prod. 198, 1431–1442. https://doi.org/10.1016/j.jclepro.2018.07.034 (2018).

Gu, W. Z. et al. Energy technological progress, energy consumption, and CO2 emissions: Empirical evidence from China. J. Clean. Prod. 236, 117666. https://doi.org/10.1016/j.jclepro.2019.117666 (2019).

Pu, Z., Qian, Y. & Liu, R. Is digital technology innovation a panacea for carbon reduction?. Technol. Econ. Dev. Econ. https://doi.org/10.3846/tede.2024.22208 (2024).

Ngepah, N. & Mwiinga, R. The impact of climate change on gender inequality in the labour market: A case study of South Africa. Sustainability https://doi.org/10.3390/su142013131 (2022).

Zhu, Y. & Liu, S. Nonlinear relationship between technological innovation and carbon emission: Evidence from maximal information coefficient approach. Int. J. Low-Carbon Technol. 19, 1633–1639. https://doi.org/10.1093/ijlct/ctae111 (2024).

Du, K. R. et al. Do green technology innovations contribute to carbon dioxide emission reduction? Empirical evidence from patent data. Technol. Forecast. Soc. Ch. 146, 297–303. https://doi.org/10.1016/j.techfore.2019.06.010 (2019).

Weina, D. et al. Green inventions and greenhouse gas emission dynamics: A close examination of provincial Italian data. Environ. Econ.Policy Stud. https://doi.org/10.1007/s10018-015-0126-1 (2016).

Gao, G.-X., Li, X., Bai, Z., Wang, J. & Jiang, H. Financing a low-carbon supply chain through online peer-to-peer lending. IEEE Trans. Eng. Manage. 71, 5044–5056. https://doi.org/10.1109/TEM.2022.3208828 (2024).

Lu, H., Xie, Z., Liu, Y. & Xu, G. Study on the impact of regional carbon emissions on enterprise technological innovation under the background of low-carbon transformation in China. Front. Environ. Sci. 12, 1290338. https://doi.org/10.3389/fenvs.2024.1290338 (2024).

Medema, S. G. The coase theorem at sixty. J. Econ. Lit. 58(4), 1045–1128. https://doi.org/10.1257/jel.20191060 (2020).

He, W., Tan, L., Liu, Z. J. & Zhang, H. Property rights protection, environmental regulation and corporate financial performance: Revisiting the Porter Hypothesis. J. Clean. Prod. 264, 121615. https://doi.org/10.1016/j.jclepro.2020.121615 (2020).

ChenGegentanaWang, B. Y. The impact of environmental regulations on enterprise pollution emission from the perspective of “Overseeing the Government.”. Sustainability 15(14), 11311. https://doi.org/10.3390/su151411311 (2023).

Li, J., Gao, J. & Liao, M. Operating risk of enterprises when adopting environmental regulation: Evidence from environmental protection law in China. Econ. Anal. Policy 81, 901–914. https://doi.org/10.1016/j.eap.2024.01.010 (2024).

Tang, H., Liu, J. & Wu, J. The impact of command-and-control environmental regulation on enterprise total factor productivity: A quasi-natural experiment based on China’s “Two Control Zone” policy. J. Clean. Prod. 254, 120011. https://doi.org/10.1016/j.jclepro.2020.120011 (2020).

Miao, C., Fang, D., Sun, L., Luo, Q. & Yu, Q. Driving effect of technology innovation on energy utilization efficiency in strategic emerging industries. J. Clean. Prod. 170, 1177–1184. https://doi.org/10.1016/J.JCLEPRO.2017.09.225 (2018).

Hodson, E. et al. U.S energy sector impacts of technology innovation, fuel price, and electric sector CO2 policy: Results from the EMF 32 model intercomparison study. Energy Econo. https://doi.org/10.1016/J.ENECO.2018.03.027 (2018).

Rokhmawati, A. The nexus among green investment, foreign ownership, export, greenhouse gas emissions, and competitiveness. Energy Strat. Rev. 37, 100679. https://doi.org/10.1016/J.ESR.2021.100679 (2021).

Ganda, F. The interplay between technological innovation, financial development, energy consumption and natural resource rents in the BRICS economies: Evidence from GMM panel VAR. Energy Strateg. Rev. 51, 101267. https://doi.org/10.1016/j.esr.2023.101267 (2024).

Guo, L. & Wang, Y. How does government environmental regulation “unlock” carbon emission effect?-evidence from China. Ch. J. Popul. Resour. Environ. 16(3), 232–241. https://doi.org/10.1080/10042857.2018.1496703 (2018).

Chen, Z., Kahn, M. E., Liu, Y. & Wang, Z. The consequences of spatially differentiated water pollution regulation in China. J. Environ. Econ. Manage. 88, 468–485 (2018).

Chen, S. Y. & Chen, D. K. Haze pollution, government governance and high quality economic development. Econ. Res. 53(02), 20–34 (2018) (In Chinese).

Lin, S., Zhou, Z., Hu, X., Chen, S. & Huang, J. How can urban economic complexity promote green economic growth in China? The perspective of green technology innovation and industrial structure upgrading. J. Clean. Prod. 450, 141807. https://doi.org/10.1016/j.jclepro.2024.141807 (2024).

Doda, B. et al. Are corporate carbon management practices reducing corporate carbon emissions?. Corp. Soc. Responsib. Environ. Manage. 23(5), 257–270. https://doi.org/10.1002/csr.1369 (2016).

Haque, F. & Ntim, C. G. Do corporate sustainability initiatives improve corporate carbon performance? Evidence from European firms. Bus. Strat. Environ. 31(7), 3318–3334 (2022).

Chen, P. Y. Relationship between the digital economy, resource allocation and corporate carbon emission intensity: New evidence from listed Chinese companies. Environ. Res. Commun. https://doi.org/10.1088/2515-7620/ac7ea3 (2022).

Andrews, D. W. K. & Lu, B. Consistent model and moment selection procedures for GMM estimation with application to dynamic panel data models. J. Econo. 101(1), 123–164. https://doi.org/10.1016/S0304-4076(00)00077-4 (2001).

Acknowledgements

The authors are grateful to the editor and the anonymous reviewers of this paper, especially the professors from the classic literature on public administration at the Macau Polytechnic University provided inspiration and guidance for this paper.

Author information

Authors and Affiliations

Contributions

Linjie Feng and Yi Shi contributed equally to this work and should be considered as co-first authors, Johnny F. I. Lam and Huangxin Chen are co-corresponding authors. Conceptualization, L.F.; methodology, L.F. , H.C., and J.F.I.L.; software, L.F.; validation, L.F. and H.C.; formal analysis, S.L., J.Z. and H.C.; investigation, L.F. and H.C.; resources, L.F.; data curation, L.F.; writing—original draft preparation, L.F.; writing—review and editing, L.F., H.C., Z.Y. and S.L.; visualization, L.F., and J.F.I.L.; supervision, S.L., H.C., and Z.Y.; project administration, H.C., Z.Y. and S.L., and J.F.I.L. All authors have read and agreed to the published version of the manuscript.

Corresponding authors

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Feng, L., Shi, Y., Yang, Z. et al. Dynamic correlation of environmental regulation, technological innovation, and corporate carbon emissions: empirical evidence from China listed companies. Sci Rep 15, 8433 (2025). https://doi.org/10.1038/s41598-025-92456-0

Received:

Accepted:

Published:

DOI: https://doi.org/10.1038/s41598-025-92456-0