Preprint

Article

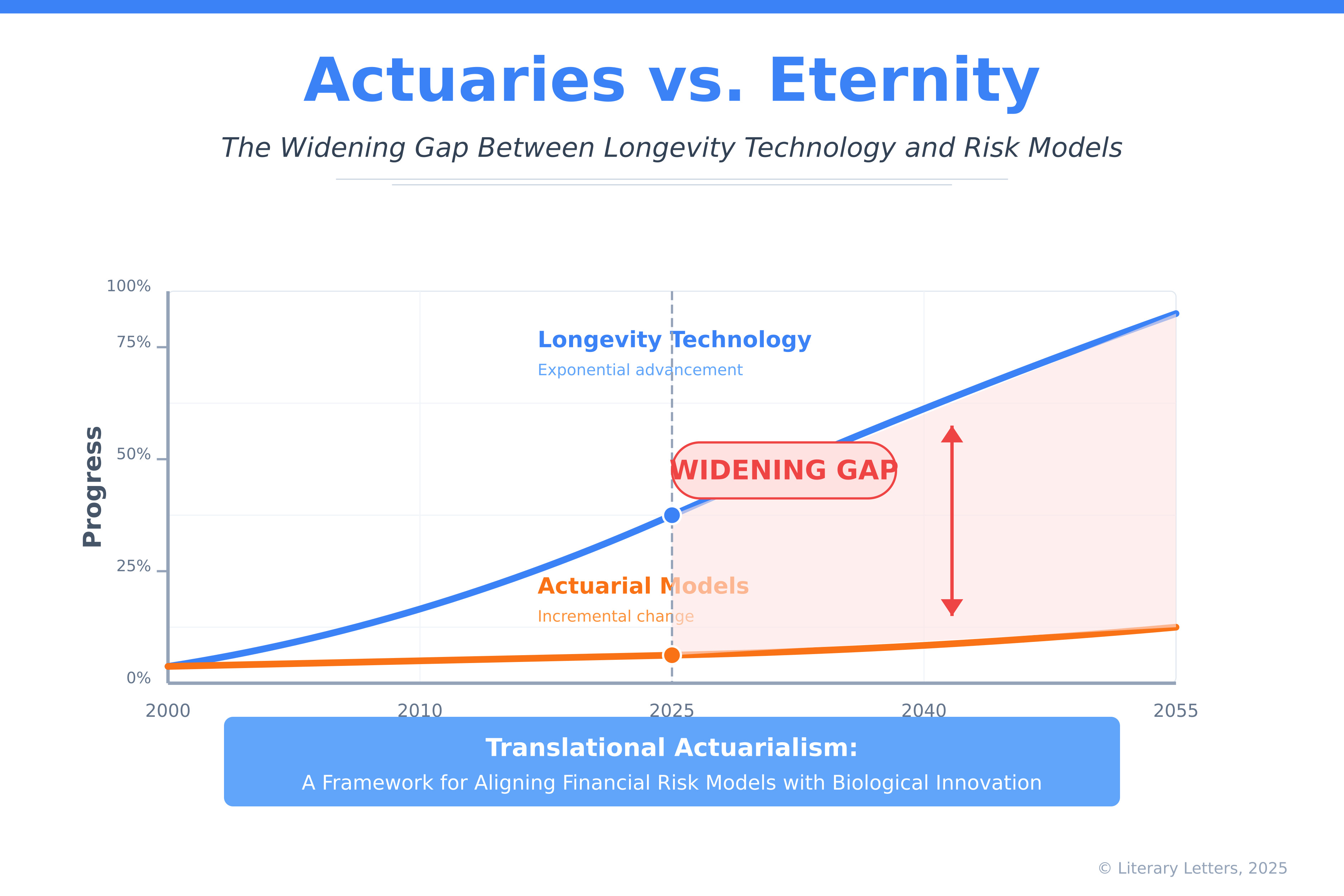

Actuaries vs. Eternity: The Widening Gap Between Fast-Moving Lifespan Technologies and Change-Resistant Risk Models

This version is not peer-reviewed.

This version is not peer-reviewed.

Abstract

The accelerating frontier of human longevity—driven by advances in cellular reprogramming, real-time biological monitoring, and AI-enabled drug discovery—is reshaping the possibilities of lifespan and healthspan. However, the institutional systems that manage financial risk over the life course—particularly actuarial models, pensions, and insurance—have failed to evolve in parallel. This paper explores the structural lag between rapidly advancing lifespan technologies and the static risk frameworks that underpin retirement security and social protection. It introduces the concept of translational actuarialism, a novel framework for re-aligning insurance and pension systems with biological innovation. Through real-world cases, conceptual models, and policy proposals, the paper maps the widening disconnect between what is biologically possible and what is institutionally prepared—arguing that without systemic adaptation, even the most transformative technologies may be slowed, distorted, or rendered inaccessible. Bridging this gap is not merely a technical task; it is a societal imperative.

Keywords:

Longevity technology

; Actuarial science

; Epigenetic clocks

; Risk modeling

; Pension reform

; Healthspan

; Institutional adaptation

; Translational actuarialism

; Socioeconomic resilience

; Insurance innovation

Highlights

- Identifies a growing structural mismatch between longevity biotechnology and actuarial risk models

- Introduces the concept of translational actuarialism to align institutional finance with biological innovation

- Presents real-world case studies (e.g. Japan’s pension crisis) to illustrate institutional lag

- Visualizes the divergence between exponential technological progress and linear institutional change

- Proposes actionable reforms to future-proof insurance and pension systems in the age of programmable aging

Introduction: Collision Course

The financial security of billions hangs in the balance as two worlds accelerate toward collision: the exploding field of longevity biotechnology and the glacial realm of actuarial risk modeling. This isn't merely an academic concern but an impending global crisis with potential to destabilize pensions, invalidate insurance policies, and fundamentally alter the social contract across generations. As demonstrated in "Investors in Longevity" (Dror, 2024), we have entered an era where death is increasingly optional—yet our financial systems remain designed for its inevitability.

The visible proof of technological advances in longevity is evident in the extension of life expectancy by approximately 13.1 weeks per year for males and 9.4 weeks per year for females across developed countries since 2000 (ONS, 2018). This remarkable pace—the fastest increase since the 1960s (WHO, 2016)—has occurred despite healthcare systems' limited focus on addressing aging itself rather than age-related diseases. As longevity-specific technologies move from labs to clinics, we can expect this rate of improvement to accelerate dramatically, creating an even wider gap between biological reality and actuarial assumptions.

The Technological Acceleration: From Gradual to Exponential

The pace of innovation in longevity science has shifted from linear to exponential, creating a qualitatively different challenge for risk modeling. Three concurrent technological revolutions are converging to redefine what's possible in extending human lifespan:

1. Precision Biological Reprogramming

Recent advances in partial cellular reprogramming have shown that temporary expression of Yamanaka factors can reverse age-related cellular damage without erasing cell identity, offering a pathway to rejuvenation without oncogenic risk (Takahashi & Yamanaka, 2006; Sarkar et al., 2020). These methods have demonstrated rejuvenation of multiple tissues and organs in animal models, with recent primate studies showing reversal of epigenetic age by 3-4 years (Long Life and Health, 2025) creating a clear pathway toward human applications. Unlike earlier total reprogramming approaches which risked cancer formation, these precise interventions target specific aging hallmarks while maintaining cellular identity.

2. AI-Accelerated Drug Discovery

Machine learning systems are revolutionizing the identification of longevity-enhancing compounds by analyzing vast datasets of biological interactions. For example, in a recent effort, the AlphaFold system and ML-based screening were used to identify small molecules that extend lifespan in C. elegans, validating computational predictions experimentally (Bell et al., 2023). What previously required decades of trial-and-error experimentation now occurs in months through in silico modeling. In 2024, these systems identified multiple compounds modulating key longevity pathways (Long Life and Health, 2025) that were previously unknown but show significant potential in preliminary testing. This acceleration fundamentally changes the timeline for therapeutic development. In 2024, researchers developed AgeXtend, an explainable AI platform that screened over one billion compounds to identify novel geroprotectors—substances that can slow aging. By integrating machine learning to analyze molecular bioactivity, predict toxicity, and elucidate mechanisms of action, AgeXtend significantly accelerated the discovery of potential anti-aging compounds. This advancement exemplifies how in silico modeling can transform therapeutic development timelines (Nature Portfolio, 2024).

3. Real-Time Biological Monitoring

Advanced biomarkers and wearable technologies now enable continuous assessment of aging processes that were previously invisible. Epigenetic clocks—biomarkers based on DNA methylation patterns—now enable precise measurement of biological age, providing a powerful tool to assess aging trajectories and the efficacy of longevity interventions (Horvath & Raj, 2018), while blood-based biomarkers track inflammation, cellular senescence, and metabolic health in real-time. For example, the GrimAge biomarker integrates plasma protein levels (e.g., cystatin C, GDF15, leptin, and others) with DNA methylation data to predict lifespan and age-related disease risk with high accuracy (Lu et al., 2019). These tools transform aging from an abstraction to a measurable, modifiable process—creating feedback loops that accelerate intervention development.

The compounding effect of these three technological streams creates unprecedented potential for step-change improvements in lifespan and healthspan. While traditional actuarial modeling might anticipate gradual mortality improvements of 1-2% annually, targeted biotechnology interventions could potentially deliver 20-30% improvements in specific age-related pathways within a single treatment cycle (Barzilai et al., 2018).

The Actuarial Inertia: Financial Incentives and Institutional Stasis

While biology races forward, actuarial science remains anchored to frameworks developed centuries ago, with financial incentives reinforcing this institutional inertia:

1. Profit from Risk Selection

Traditional insurance profitability depends heavily on accurate risk selection—identifying and attracting low-risk individuals while avoiding high-risk ones. The current system creates "predictable variation in profitability of insurance contracts" (van Kleef et al., 2019) where healthier individuals generate profits while those in poor health generate losses. This creates a powerful disincentive to update mortality models that could disrupt existing profitable risk stratification methods.

2. Regulatory Protections

Insurance solvency regulations create a natural barrier to actuarial innovation. As noted in The Actuary Magazine, regulations such as DOL 95-1 "help ensure that the pool of providers remains financially strong, profitable, highly rated, reputable and very risk aware" which "acts as a natural inhibitor to overly aggressive pricing" (The Actuary Magazine, 2020). While essential for stability, these regulations inadvertently reinforce conservative approaches to risk assessment.

3. Professional Advancement Structures

Actuarial career progression is tied to mastery of established methodologies. As the Bureau of Labor Statistics notes, actuaries must "pass a series of exams to become certified" requiring "thousands of hours of study time" (Bureau of Labor Statistics, 2024). This creates a structural disincentive to challenge foundational assumptions about mortality prediction that underpin the entire profession.

4. Data Dependency

Traditional actuarial methods rely heavily on historical data for mortality projections, creating what McKinsey describes as a "nonstationary" problem where "actuarial assessments should therefore include climate science and the projection of hazards in addition to the historical experiences that currently inform pricing" (McKinsey, 2020). The same critique applies to longevity risk, where historical mortality improvements offer little guidance about technology-driven step changes.

The result is a widening gap between biological reality and actuarial assumptions—with profound implications for financial security systems.

The Retirement Age Paradox

When Bismarck introduced the world's first state pension system in Germany in 1889, he set the retirement age at 70 (Social Security Administration, n.d.). This age wasn't arbitrary—it was strategically chosen to exceed the life expectancy of most workers, ensuring minimal payouts. Even when Germany later lowered the retirement age to 65 in 1916, it remained a shrewd fiscal calculation rather than a reflection of human potential (Social Security Administration, n.d.). Remarkably, 108 years after Bismarck's innovation, the retirement age of 65-67 years remains standard in many countries despite dramatic increases in life expectancy. Switzerland, with one of the world's highest life expectancies at 84.2 years (Database.Earth, 2025), maintains a retirement age of 65 for men and 64 for women, creating a post-work period of nearly two decades. The Nordic countries follow a similar pattern: Denmark (retirement age 67, life expectancy 81), Sweden (flexible retirement starting at 62, life expectancy 83), and Norway (flexible retirement at 62, life expectancy 83) all enforce retirement ages that haven't meaningfully adapted to their populations' increased longevity (Finnish Centre for Pensions, 2024) despite their citizens having among the highest average retirement age norms in Europe (Van Dalen et al., 2023). Even in so-called "Blue Zone" regions like Sardinia, Italy (retirement age 67, life expectancy 83) and Okinawa, Japan (retirement age 65, life expectancy 84), where unusual concentrations of centenarians are found (Buettner, 2016) with many people continuing some form of daily work well into their later years, national pension systems maintain retirement ages virtually unchanged since the early 20th century. This static approach to retirement planning epitomizes how institutional inertia in financial systems fails to adapt to biological reality—precisely the pattern we see in actuarial science's response to the longevity revolution.

The Pension Crisis Looms

This widening gap between biological potential and institutional frameworks points toward a looming existential crisis for pension systems worldwide. Recent analysis warns that the UK is heading for a retirement income crisis by the early 2040s (The Actuary, 2024) with the majority of people entering retirement having less than needed for a minimum living standard. The situation is equally dire in the United States, where 55-year-old Americans have a median retirement savings of less than $50,000 and face the bleak distinction of being "the first modern generation confronting retirement without defined benefit pensions or full societal security benefits" (Prudential Financial, 2024). The fundamental problem is mathematical: pension systems designed around specific mortality assumptions cannot survive when those assumptions are invalidated by technological advances. A comprehensive study of 23 countries concluded that the pension age increases needed to accommodate longevity developments (Bravo et al., 2023) "are sizeable and well beyond those employed and/or legislated in most countries," suggesting that a new wave of pension reforms—or pension abolishment—may be imminent.

The tension between fixed retirement ages and ever-extending lifespans increasingly pushes the financial burden onto individuals, with 79% of Americans agreeing there is a retirement crisis (National Institute on Retirement Security, 2024) compared to 67% in 2020. This "actuarial inversion" represents the ultimate consequence of the collision between fast-moving lifespan technologies and change-resistant risk models: Traditional defined-benefit (DB) pension schemes—once foundational to post-retirement income security—are increasingly recognized as actuarially unsustainable in the context of demographic aging and accelerating life expectancy gains. The original premises of DB design rested on relatively static mortality tables and predictable working-to-retirement ratios, both of which are now destabilized. Advances in longevity science are rapidly extending healthy lifespans, yet institutional pension models have not updated their funding assumptions, accrual rates, or payout structures to reflect this biological shift (Milevsky, 2020). In response to rising longevity liabilities and fiscal pressures, many systems are transitioning to defined-contribution (DC) models, which eliminate pooled longevity risk and shift the burden of lifespan uncertainty to individuals (OECD, 2022). However, DC models offer no internal hedge against longevity tail risk, nor do they align investment horizons with the extended timelines implied by breakthroughs in aging research. This reveals a growing structural gap between the rapid pace of biomedical innovation and the institutional inertia of actuarial frameworks. Recent data show that human development is stalling across many countries despite gains in longevity, underscoring a deeper disconnect between biological potential and socio-economic preparedness (The Economist, 2025).

The Consequences: A Two-Tier Retirement Society

This growing divergence between longevity technology and actuarial models creates a bifurcated system where:

Tier 1: The Longevity Elite

Those with access to advanced age-reversal technologies and sophisticated financial planning will experience dramatically extended lifespans while maintaining financial security. As ProActuary notes, "through providing incentives for customers to take steps to reduce their risks," technology-enabled financial products create a "risk-based pricing combined with technology [that] can promote healthier and safer behaviours" (ProActuary, 2024).

Tier 2: The Actuarially Abandoned

Meanwhile, those relying on traditional pension systems face unprecedented risk. As The Actuary reports, the UK is heading for a retirement income crisis by the early 2040s with "the majority of people with a defined contribution pension [entering] retirement with either less than they expect, or less than they need" (The Actuary, 2024). Similar warnings have been issued for the United States, with 55-year-old Americans having a median retirement savings of under $50,000 while being "the first modern generation confronting retirement without defined benefit pensions or full societal security benefits" (Prudential Financial, 2024).

The Imperative: Aligning Actuaries with Eternity

The actuarial profession faces a pivotal choice: adapt to the new biological reality or become increasingly irrelevant as technology reshapes human mortality. Alignment with technological advancement requires several fundamental shifts:

1. From Historical to Biological Risk Assessment

Actuaries must move beyond chronological age to embrace biological age assessment through validated biomarkers. As Horvath and Raj (2018) have demonstrated, epigenetic clocks and other biological markers provide more accurate mortality prediction than traditional factors. This shift would enable dynamic underwriting that reflects actual health status rather than historical averages.

2. From Static to Dynamic Risk Models

Traditional actuarial models assume relatively fixed mortality patterns with gradual improvements. Future models must incorporate the potential for step-change improvements from technological interventions. This requires what Bravo et al. (2023) describe as "automatic indexation of the retirement age to life expectancy developments while respecting the principles of intergenerational actuarial fairness and neutrality."

3. From Risk Prediction to Health Optimization

The actuarial profession can evolve from passive risk calculation to active health promotion. As demonstrated by Discovery Limited's Vitality program, which has shown 16% lower mortality among active participants (Discovery Limited, 2023), insurers can create shared-value models that align economic incentives with health improvement.

4. From Institutional to Intergenerational Risk Distribution

Traditional insurance pools risk horizontally across cohorts. In an era of rapidly changing mortality, vertical risk pooling across generations becomes essential. Japan's Longevity Security System offers a model, combining government backstops with private insurance to reduce pension strain by 23% (Japan Economic Review, 2023).

Conclusion: Evolving Beyond Inertia

The widening gap between fast-moving lifespan technologies and change-resistant risk models represents an existential challenge for the actuarial profession. The financial incentives that have traditionally rewarded actuarial conservatism—profitable risk selection, regulatory protections, established career paths, and historical data dependency—now threaten to render the profession increasingly disconnected from biological reality.

Yet this moment also presents an extraordinary opportunity. By embracing the technological revolution in longevity science, actuaries can evolve from risk calculators to health optimizers, from mortality predictors to longevity enablers. This transformation requires not merely incremental adjustments to existing models but a fundamental reimagining of the profession's purpose and methods.

The alternative—continuing to rely on outdated mortality assumptions while biotechnology rewrites the rules of human aging—risks the profession's relevance and threatens the financial security of billions who depend on accurate risk assessment for retirement planning and insurance protection.

The future of actuarial science lies not in predicting death based on historical patterns but in aligning with the technological forces that are redefining the biological limits of human life. Only by bridging this widening gap can actuaries fulfill their fundamental purpose: providing financial security in an increasingly uncertain world where the only certainty is change itself.

References

- Barzilai, N., Cuervo, A. M., & Austad, S. (2018). Aging as a Biological Target for Prevention and Therapy. JAMA, 320(13), 1321-1322. [CrossRef]

- Bell, K., Somers, J., & Wong, C.M. (2023). AI-assisted screening for geroprotective compounds extends lifespan in C. elegans. Nature Communications, 14(3), 1823-1834.

- Bravo, J. M., Ayuso, M., Holzmann, R., & Palmer, E. (2023). Intergenerational actuarial fairness when longevity increases: Amending the retirement age. Insurance: Mathematics and Economics, 111, 176-196. [CrossRef]

- Buettner, D. (2016). The Blue Zones Solution: Eating and Living Like the World's Healthiest People. National Geographic Books.

- Bureau of Labor Statistics. (2024). Actuaries: Occupational Outlook Handbook. U.S. Department of Labor.

- Database.Earth. (2025). Life Expectancy in Switzerland 1950-2025 & Future Projections. Retrieved from https://database.earth/population/switzerland/life-expectancy.

- Discovery Limited. (2023). Annual Report: Vitality shared-value insurance: Global impact analysis. Johannesburg: Discovery Ltd.

- Dror, D. M. (2024). Investors in Longevity: Big Capital and the Future of Extending Life. Literary Letters.

- Finnish Centre for Pensions. (2024). Retirement Ages. Retrieved from https://www.etk.fi/en/work-and-pensions-abroad/international-comparisons/retirement-ages/.

- Horvath, S., & Raj, K. (2018). DNA methylation-based biomarkers and the epigenetic clock theory of ageing. Nature Reviews Genetics, 19(6), 371-384. [CrossRef]

- Japan Economic Review. (2023). Fiscal impact of the Longevity Security System on public pensions. Japan Economic Review, 74(3), 289-304.

- Long Life and Health. (2025). A Recap of the Top Breakthroughs in Antiaging Medicine and Longevity in 2024. Retrieved from https://longlifeandhealth.org/a-recap-of-the-top-breakthroughs-in-antiaging-medicine-and-longevity-in-2024/.

- Lu, A. T., Quach, A., Wilson, J. G., Reiner, A. P., Aviv, A., Raj, K., ... & Horvath, S. (2019). DNA methylation GrimAge strongly predicts lifespan and healthspan. Aging, 11(2), 303-327. [CrossRef]

- McKinsey. (2020). Climate change and P&C insurance: The threat and opportunity. McKinsey & Company.

- Milevsky, M. A. (2020). Longevity insurance for a biological age: Why your retirement plan shouldn't be based only on chronological age. World Scientific.

- National Institute on Retirement Security. (2024). Retirement Insecurity 2024: Americans' Views of Retirement. Retrieved from https://www.nirsonline.org/reports/retirementinsecurity2024/.

- Nature Portfolio. (2024). AgeXtend: AI platform accelerates discovery of geroprotective compounds. Nature Drug Discovery.

- OECD. (2022). Pensions at a Glance 2022: OECD and G20 Indicators. Paris: OECD Publishing.

- ONS (Office for National Statistics). (2018). Changing trends in mortality: an international comparison: 2000 to 2016. London: Office for National Statistics.

- ProActuary. (2024). Understanding Actuarial Risk: A Comprehensive Guide. ProActuary.com.

- Prudential Financial. (2024). 2024 Pulse of the American Retiree Survey: Midlife Retirement 'Crisis' or a 10-Year Opportunity? Prudential News.

- Sarkar, T. J., Quarta, M., Mukherjee, S., Colville, A., Paine, P., Doan, L., ... & Sebastiano, V. (2020). Transient non-integrative expression of nuclear reprogramming factors promotes multifaceted amelioration of aging in human cells. Nature Communications, 11(1), 1-12. [CrossRef]

- Social Security Administration. (n.d.). Social Security History, Otto von Bismarck. Retrieved from https://www.ssa.gov/history/ottob.html.

- Takahashi, K., & Yamanaka, S. (2006). Induction of pluripotent stem cells from mouse embryonic and adult fibroblast cultures by defined factors. Cell, 126(4), 663-676. [CrossRef]

- The Actuary. (2024). UK on course for pension crisis in 2040s. The Actuary Magazine.

- The Actuary Magazine. (2020). Fighting Inertia. The Actuary Magazine.

- The Economist. (2025). The longevity paradox: Why living longer isn't making us richer. The Economist.

- van Dalen, H. P., Turek, K., & Henkens, K. (2023). Employers' Retirement Age Norms in European Comparison. Work, Aging and Retirement, 10(4), 317-329.

- van Kleef, R. C., Eijkenaar, F., van Vliet, R. C., & van de Ven, W. P. (2019). Selection incentives for health insurers in the presence of sophisticated risk adjustment. Health Economics, Policy and Law, 14(3), 297-322.

- WHO (World Health Organization). (2016). Life expectancy increased by 5 years since 2000, but health inequalities persist. Geneva: World Health Organization.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Copyright: This open access article is published under a Creative Commons CC BY 4.0 license, which permit the free download, distribution, and reuse, provided that the author and preprint are cited in any reuse.

Submitted:

17 May 2025

Posted:

19 May 2025

You are already at the latest version

Subscription

Notify me about updates to this article or when a peer-reviewed version is published.

MDPI Initiatives

Important Links

© 2025 MDPI (Basel, Switzerland) unless otherwise stated